Are you amongst those people for whom, their cars are their most prized possessions? However renewing insurance every year has become extravagant and the thought of a higher premium gives you the chill! Let’s find out ways to combat your car insurance renewal cost.

Whether it's a BMW or an Alto, who cares? A second hand car or a brand new one! Somehow we tend to get possessive about them even if they are not supposed to be the most expensive priced possessions we own. Now a days where everything is EMI based, affording a car ain't big deal!

No wonder we have so many cars on the roads today.

For a country like India where bad roads and traffic is still a pain, we should compulsorily renew our car insurance in order to avoid huge expenses in case of an accident. If the matter was in our hands, I am sure we wouldn’t have opted to spend on renewing the car insurance policy, even if it didn’t make much difference to our pockets. However, one good thing which the government has compelled is insurance and we are yet not obliged about it. Because..

The biggest reason people hesitate to buy insurance is rising premiums. If a car’s value is depreciating every year, why does the insurance renewal premium not lower with it? And that has not been the case for last few years. Since we have seen prices soaring instead of decreasing.

At first the IRDAI (Insurance Regulatory and Development Authority of India) proposed up to 50% increase in the third party motor insurance and later it was demonetization which paved way to GST. Increase in premium was also because the IRDAI wanted to help the insurance companies to strike a balance between number of claims made and the loss ratios of the insurers. However, there are ways where you can still manage to reduce your premium to a considerable amount without major compromise on your policy. Let's find how?

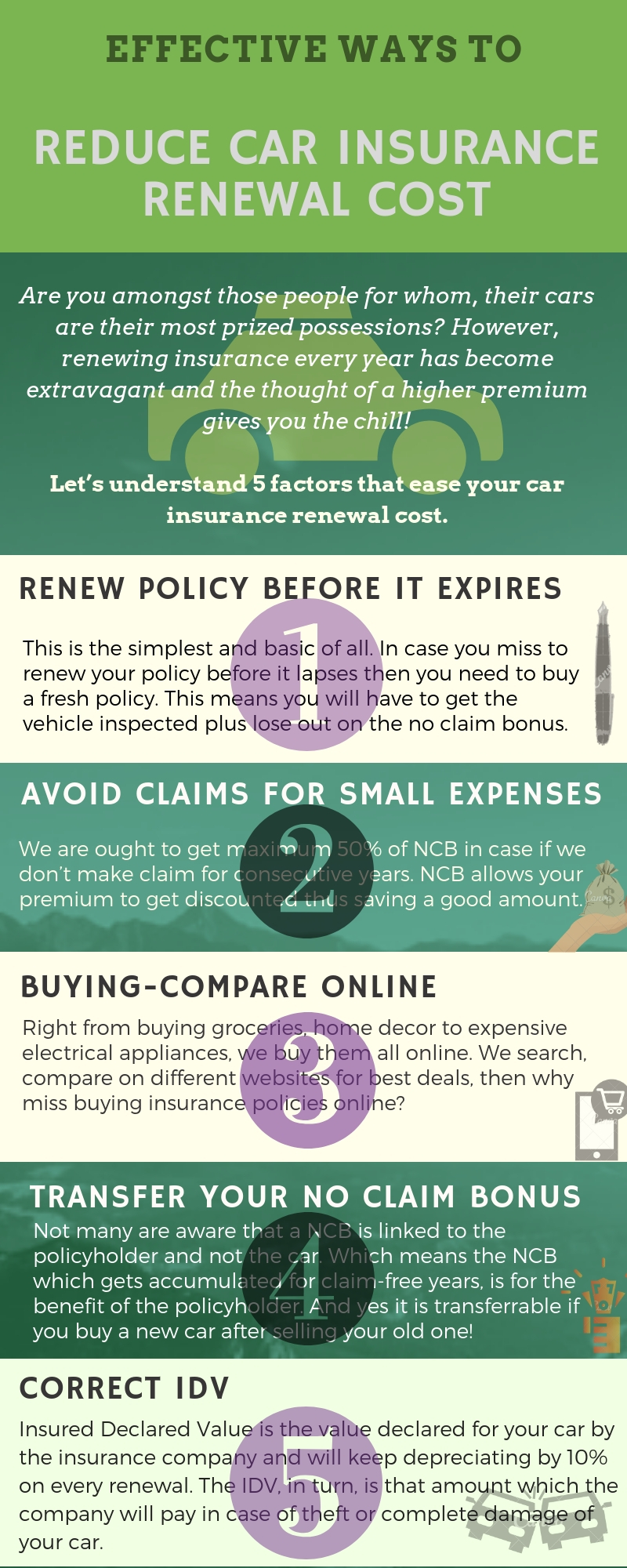

Top five ways to reduce car insurance renewal cost

Renewing policy before it expires

This is the most simplest and basic of all. In case you miss to renew your policy before it lapses then you need to buy a fresh policy. This means you will have to get the vehicle inspected plus lose out on the NCB (No claim bonus).

And no NCB means no discount on your policy. All these factors are enough for a good increase in premium.

Avoid making claims for small expenses

We are ought to get maximum 50% of NCB in case if we don’t make claim for consecutive years. NCB allows your premium to get discounted thus saving a good amount.

For example: Your car gets damaged in the parking and has a small dent. The cost for repairing the dent is lesser as compared to the NCB accumulated. Would you still want to let go of the discount by claiming a negligible amount?

And in case if you happen to make a claim, next year while renewing you might have to pay huge amount for the premium, since you have lost the accumulated bonus.

So, it's wise to think twice before claiming for a small amount which can be easily shelled from your pockets.

Buying and comparing premiums online

Right from buying groceries, home decor to expensive electrical appliances, we buy them all online. We search, compare on different websites for best deals, then why miss buying insurance policies online?

The advantage of buying an insurance policy is that you can compare premiums of different insurance companies and choose them on basis of reviews, popularity, premiums, claim settlement ratios etc.

Most importantly, the best thing about buying insurance online is that you get them all on heavy discounted rates. Hope these reasons are more than enough for you to buy a policy online.

Transferring your No claim bonus (NCB)

Not many are aware that a NCB is linked to the policyholder and not the car. Which means the NCB which gets accumulated for claim-free years, is for the benefit of the policyholder. And yes it is transferrable if you buy a new car after selling your old one!

However, always remember to get a NCB certificate for your vehicle from the insurance company, which will help you to get a discount while buying a new car policy. Also even if you are not buying a new car immediately, please transfer the NCB as the NCB retention certificate is valid for 3 years.

Mentioning correct IDV (Insured Declared Value) and other details

IDV is the value declared for your car by the insurance company and will keep depreciating by 10% on every renewal. The IDV in turn is that amount which the company will pay in case of theft or complete damage of your car.

However, most of us want a good IDV and don’t consider depreciating it every year, and that impacts the premium of your car insurance policy. Please remember to mention the correct IDV of your car which would help in optimizing your premium.

Also mentioning correct information is vital to lower the premiums. Details like your car manufacturing year, RTO region, mentioning previous claim if any impacts the premium of your vehicle insurance to a lot of extent.

With these little tips I am sure renewing your car insurance policy will not be a task anymore. And you will have an insurance cover all the time. So think wise, act wise!

Here are some top tips that will surely reduce your car insurance renewal cost

Recommended Read: 10 Simple Steps to Reduce Car Insurance Premium