How do you rate yourself as a Responsible Driver on a scale of 1 to 5? Did you answer a modest 4? Then the benefits of no-claim bonus on your car insurance premium will definitely please you.

As the name suggests, no claim bonus or NCB is a discount offered by car insurance companies in the premium of the forthcoming year’s insurance, when one has not made any claims in the previous year. Although, the terms and conditions differ from insurer to insurer, a no-claim bonus is often regarded as the best way to reduce one’s cost of own-damage premium by up to 50%.

Building NCB

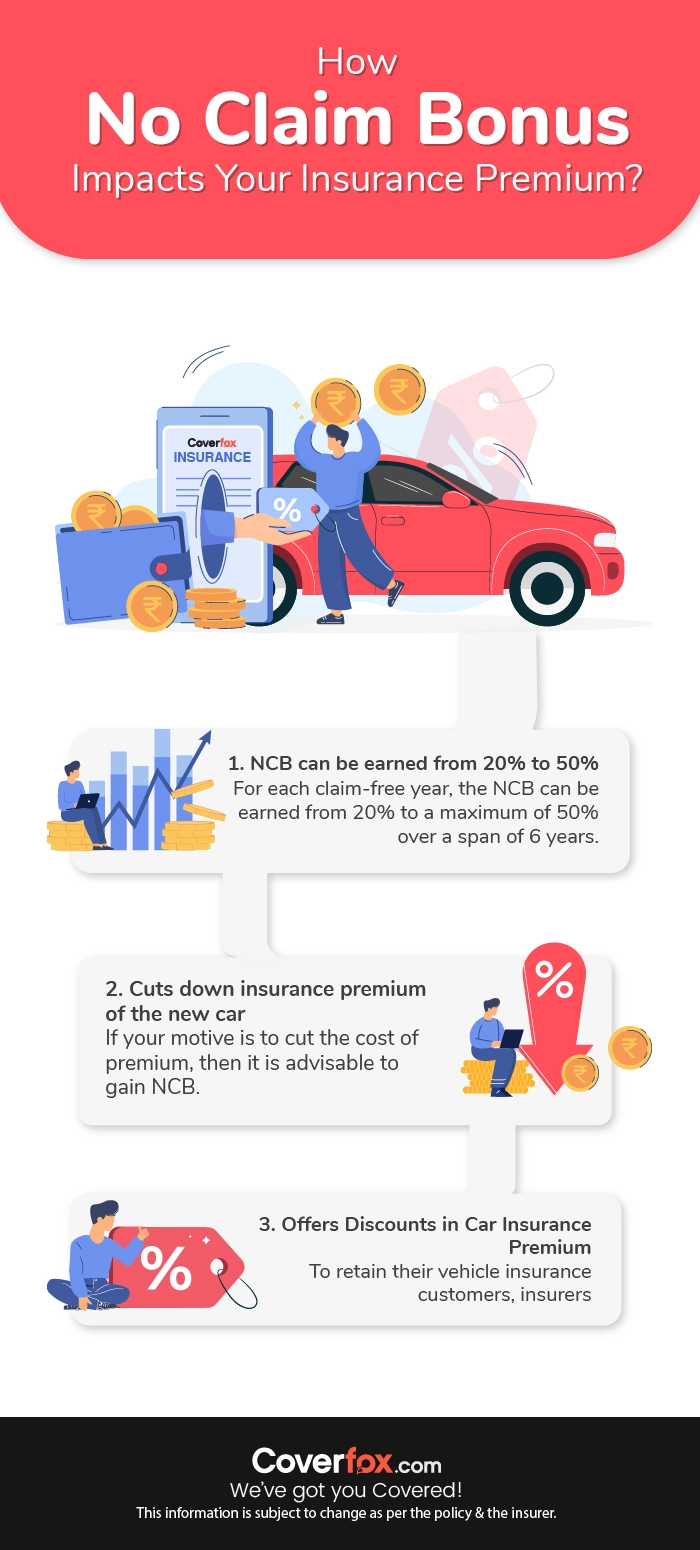

NCB is offered as an advantage or benefit to a vehicle owner for not claiming the car insurance. For each claim-free year, the NCB can be earned from 20% to a maximum of 50% over a span of 6 years. If your motive is to cut the cost of premium, then it is advisable to gain NCB. This will in turn also keep you disciplined as a vehicle owner and driver.

The perks of NCB

In general a no-claim bonus is not about not claiming on one’s insurance policy. It is actually about prudently using one’s vehicle. In other words, it is a reward to the vehicle owner for carefully and sensibly maintaining the vehicle.

For example, if one decides to sell a decade old Maruti and buy a brand new Skoda, the no-claim bonus is liable to be shifted or passed on to the new vehicle, thus cutting down the premium on the insurance of the new car.

In case a vehicle owner with a past record of NCBs decides to change his insurer, he can easily get it done with the help of a renewal notice or letter from the previous insurer confirming the NCB entitlement.

Discounts in Car Insurance Premium

Insurance companies take no chance to lose their customers. To retain their car or two-wheeler insurance customers, the insurers offer lucrative no-claim bonus plans with increasing discounts on premium every claim-free year.

No-claim bonus usually start with a general 20% discount for the second year, 25% for the third year, 35% for the fourth year, 45% for the fifth year, and 50% for the sixth year. There might be certain variations in the percentage slab from one insurer to another.

Also in certain cases, the insurer might not subject discounts on NCB post five years. Sometimes, on failing to renew the policy, the NCB gained might get dissolved. However it totally depends upon the insurance company’s discretion as per the IRDA guidelines.

The table below simplifies it further to understand how NCB is earned

Just Remember!

While discounts through no-claim bonus are earned over a spans of years, always remember that these can only be used on one policy at a time. In no case can it be shared across two policies. In an adverse case, if the policy is cancelled before the completion of the policy year, no-claim bonus is not earned for that year.

Apart from this, in case of a switching from one insurer to another, the NCB retention letter issued from the old insurance company to the new one must have the exact number of years through which no-claim discount was earned and the expiry date of the last insurance policy.

Want to learn more about NCB for car insurance? Watch this cool video!