Buying car insurance can be tricky - especially considering the multiple coverage options and the add-ons on offer. Let's find out various add-ons to secure your car well.

India Is A Fast Emerging Country, But Development Comes At A Price

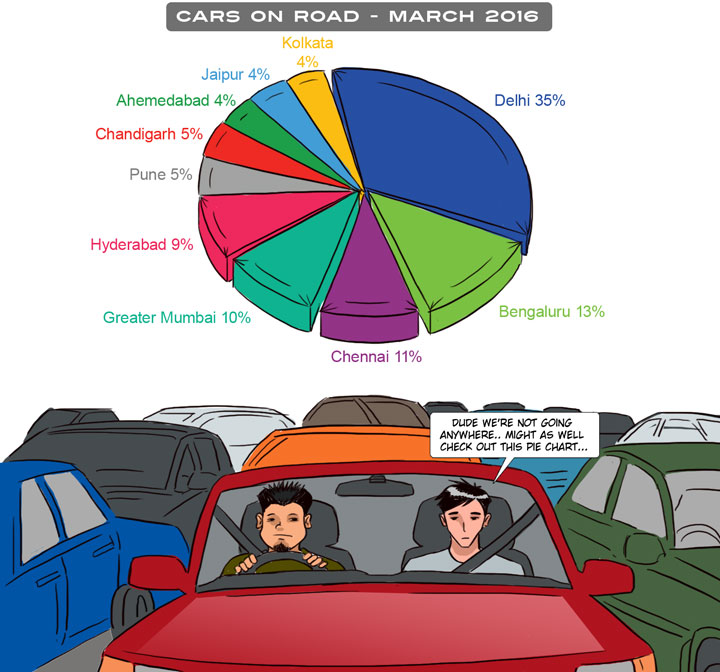

9.8% rise in the domestic car sales in 2015 compared to 2014

Delhi tops the list with the highest number of cars (2,172,069)

Kolkata owns the least cars (222069).

Your Car Could be At Risk – Even If You’re A Cautious Driver

We all know that Indian roads are not well-equipped to handle this growing number of automobiles, and it’s not biomolecular science to realize the amount of crowding and chaos these vehicles will bring about. And however cautiously you drive, this congestion and turmoil on the road is bound to scratch or dent your car and may even result in occasional collisions.

While the Government is making every effort to explore techniques and means to tackle this matter, it is your own obligation to protect yourself financially in case your car is victimized on the road. A well-customized comprehensive car insurance policy with suitable add-on covers is your only Messiah in the event of any damages/losses caused to your car or any other third party.

In this article, let’s understand some of the worthy add-ons offered in your comprehensive car insurance policy. Although they come at a slightly higher premium, trust me, it’s totally worth every penny.

Zero Depreciation Cover

Without a Zero Depreciation Cover, during the claim, you pay a difference from your own pocket to cover the costs for the repair/replacement of the depreciated parts of your car. With this cover, you are at peace.

The catch: Not available for cars more than five years old.

Engine Protector

Engine Protection cover is extremely useful if you live in one of the heavy rainfall prone areas like Mumbai. It offers to cover the repair costs of the car’s engine in case it is damaged due to the flooding.

The catch: Some insurers may not offer this add-on for cars older than five years. Also, you should never trigger the engine when the car is flooded. If the engine gets damaged due to your trigger, that’s considered as a consequential loss and is not covered by the insurance.

Consumable Cover

Consumable cover offers to compensate towards the replacement costs of consumable items used during the repair like nuts and bolts, screws, washers, engine oil, etc. that are otherwise not covered.

The catch: This cover may or may not be available for older cars.

Invoice Protection

This is a very handy feature in case of theft or total damage to your vehicle where you get compensated for the original invoice value of your vehicle including the registration charges and the road tax paid and not by the IDV (Insured Declared Value).

The catch: Not available for cars older than three years.

Roadside Assistance

Picture a situation - you are stranded in the middle of a highway with no help at hand. Scary, huh? With this cover, you need not be. With just a phone call, the insurance company will arrange all emergency services such as towing, medical assistance, battery jump start, arrangement for fuel, etc.

The catch: There’s no catch here. Very convenient if you are one of those enthusiastic travelers.

To understand the subject better, let’s take the example of four commuters, Mr. Mhatre (Mumbai), Mr. Mehta (New Delhi), Ms. Murthy (Chennai) and Mr. Mukherjee (Kolkata).

Let’s assist them to pick the right add-ons for their precious set of wheels depending on their driving experiences.

Mr. Mhatre From Amchi Mumbai

Mr. Mhatre is an Investment Banker in Mumbai and travels from Borivali to Lower Parel every day in his car. Based on his driving frequency and the weather conditions of Mumbai, we recommend the below add-on covers for him.

Zero Depreciation Cover:

- For complete protection against any losses or damages to his car including the depreciating parts.

Engine Protector:

- To cover any damages caused to his car’s engine when the Mumbai rains are at its destructive best.

Consumables Cover:

- To cover the costs for any consumables used during the repairs.

Sadda Mr. Mehta From The Capital

Mr. Mehta is a Businessman, who owns an Export House in Karol Bagh, New Delhi. The demands of his business require him to travel around Delhi and nearby areas. Based on his case, we recommend the following add-ons for his car.

Zero Depreciation Cover:

- For complete protection against any repairs or damages to any parts of his car.

Road Side Assistance:

- For completely stress-free highway drives without having to worry about the unexpected.

Invoice Protection:

- As Mr. Mehta often travels to areas that are known to be notorious and prone to car thefts; this cover will be of great help if he ever turns a victim of the motor vehicle theft.

Ms. Murthy From Chennai

Ms. Murthy is a Chartered Accountant in Chennai and travels from her home in Adyar to her office in Karappakam every day. Depending on the city conditions and her driving needs, we suggest the below add-ons for complete peace of mind.

Zero Depreciation Cover:

- To protect her against all the expenses if she ever raises a claim on her policy. All she has to pay are the compulsory charges.

Engine Protector:

- For complete protection especially when the Chennai monsoon is at its worst. Do we even need to say anything here?

Road Side Assistance:

- As Ms. Murthy travels alone, this add-on could be a savior in case of any crisis on the road.

Consumables Cover:

- With a little extra amount, she can breathe relief. All her expenses well covered during the claim without having to pay anything from her pocket except the compulsory deductible.

Mr. Mukherjee From Amor Sonar Bangla - Kolkata

Mr. Mukherjee is a retired Government Employee, who adores nature. This love for the flora and fauna motivates him to visit picturesque places around Kolkata in his ten yrs old car. As his car is pretty old, it’s not eligible for most of the add-ons that we discussed above. However, few insurers can still offer him a Roadside Assistance Cover for those trouble-free long drives that he absolutely enjoys.

Road Side Assistance:

- To tackle any unfortunate events without any help at hand. At his age, nothing can beat the convenience of easy arrangement of the emergency services when you need them the most.

From the above instances, we have learned that not all policies are alike, and each one can be customized with appropriate add-ons to satisfy your individual requirements. Therefore, depending on the weather conditions of the city you live in and the kind of trips you take, assess your needs and opt for the most fitting ones. Something like an Engine Protection Cover may turn out to be a real blessing in regions like Mumbai or Chennai but may prove to be an utter waste for a vehicle in Rajasthan.

Turn your journeys into delightful experiences with the proper cover and the right add-ons!

Source:

http://www.thehindu.com/business/Industry/car-sales-hit-record-high-in-india-over-2-million-units-sold-in-2015/article8092367.ece

http://www.mapsofindia.com/top-ten-cities-of-india/top-ten-highest-no-of-car-ownership.html