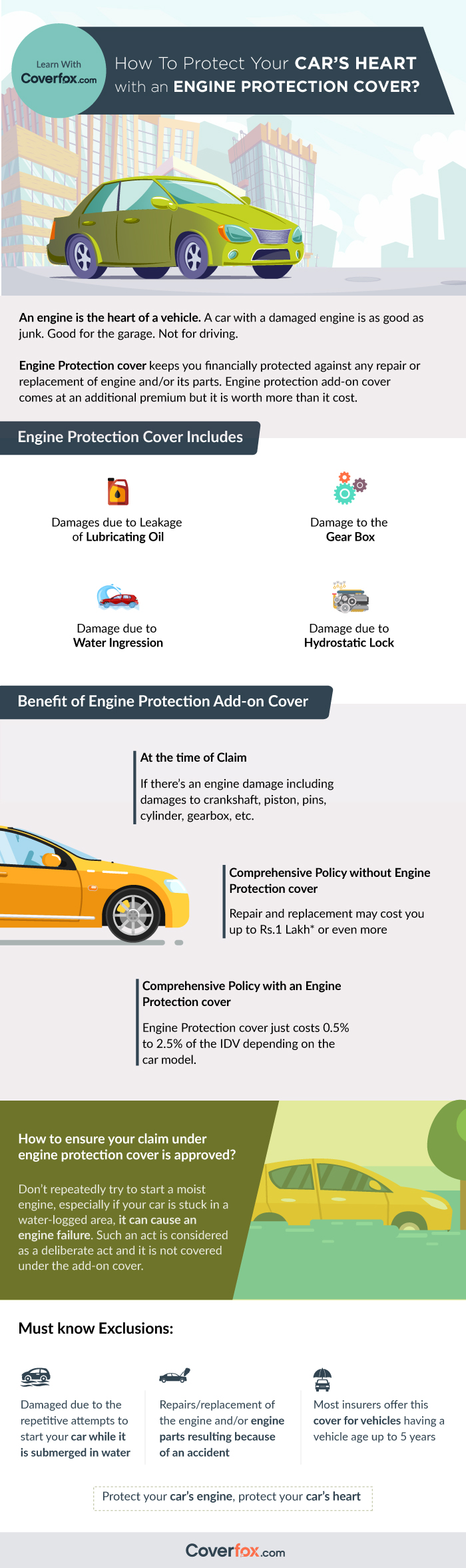

Water ingression, leakage of lubricating oil, etc. can damage your car’s engine. Engine damages are not covered under a comprehensive policy. But with the help of an Engine protection add-on cover you can enhance your coverage and stay financially covered.

Engine Protection Add-on Cover FAQs

1) On August 29, 2017, in Mumbai, my car was stuck in a water-logged area, which has damaged the car's engine severely. Unable to start my car. Is this covered under the engine protection cover?

Yes, it is covered under the scope of engine protection add-on cover. Floods are considered as a genuine and a valid reason for a car insurance claim. Any damage to the vehicle engine or the parts of the engine due to the water ingression is covered.

2) Who should buy engine protection add-on cover?

Many areas are prone to water logging and car owners face a lot of problems during the monsoon. And if you reside along or nearby such areas, it is advisable to opt for this cover without a question. Moreover, if you own a high end expensive car, then definitely you must go for an engine protection cover. However, if your car is too old, or if you own a second-hand car, then this may not be a suitable option for you.

3) What is Hydrostatic lock and how it benefits if one has an engine protection add-on cover?

If the engine is in a moist condition or if it comes in contact with water, it prevents the engine from starting. Excessive and repetitive cranking attempts can cause considerable damage to the parts of the engine - cylinder wall, piston, connecting rod, etc. Consequentially, leading to repair or even complete replacement of the engine and its parts.

Hydrostatic lock is not a damage caused directly due to the water ingression, but rather due to the repetitive attempts to start a car when the engine is in moist condition or in contact with water. Therefore, it is not covered under a comprehensive policy. And this is where an engine protection add-on cover helps. An engine protection add-on covers hydrostatic lock. However, please note, that an attempt to start a car when submerged in water is not covered.

Protect your car's engine, protect your car's heart!

Happy Driving!

Faqs on Engine Protection Cover Addon

Who should buy an Engine Protection Cover?

There are many scenarios where damage to the engine of your car is particularly likely. The cost of engine protection cover comes at an additional premium from your comprehensive car insurance policy and is usually priced at approximately 2% of the price of your car.

You should buy an engine protection cover if,

- You live in an area prone to natural calamities, especially floods.

- Your car is new or a luxury car, meaning that the price of repair would be particularly high.

- You have purchased an expensive car.

What is Engine Protect Cover in Car Insurance? And why is it important?

The Engine Protection Cover offers compensation for liabilities arising from damage to your car’s engine, for replacement of the engine, or for parts. There can be many reasons which cause the engine to be damaged in such a way, resulting in the need for this particular add-on of engine protection coverage.

Does car insurance cover if your engine blows?

The National Association of Insurance Commissioners says that maintenance, such as an oil change, is typically not included in car insurance coverage. Whether it's routine maintenance, a mechanical failure, or a blown engine, car insurance will most likely not cover the costs, until you have a specific add-on cover for it.

What are the inclusions under the engine protection cover?

This add-on cover includes:

- Damages sustained by the engine parts due to water ingression.

- Damages incurred to the engine and its parts due to leakage of lubricating oils.

- Physical damages incurred to the differential parts or gearbox.

- Engine failure due to an attempt to start a wet engine.

Besides, engine protection cover, what all add-on covers are included in a car insurance policy?

A few of the add-on covers under a car insurance policy are zero-depreciation cover, NCB cover, and invoice cover.