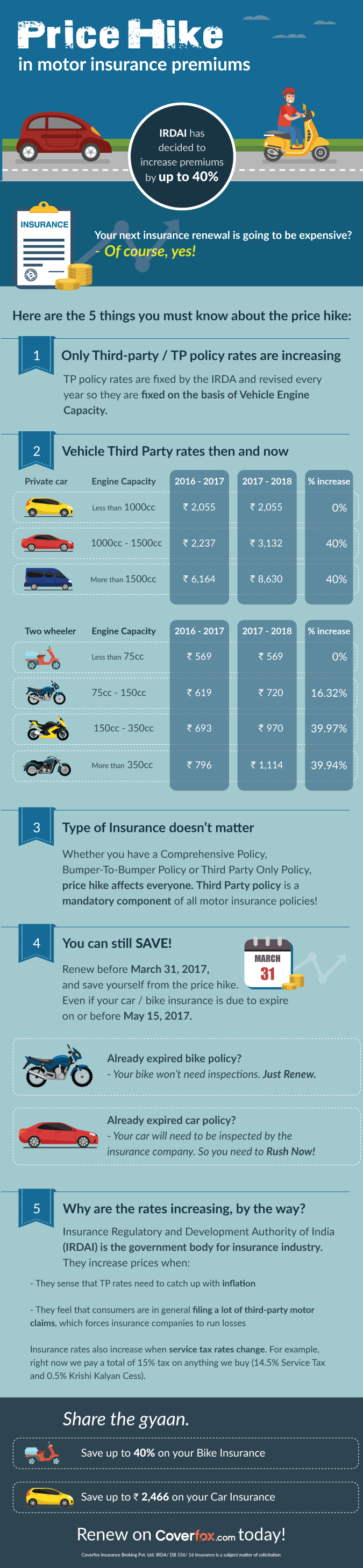

Car insurance prices are increasing by up to 50 percent from April 1. Check out this infographic to understand how this affects you and how you can save.

Share the gyaan with all your friends! :)

FAQs

What does a premium mean for car insurance?

An insurance premium is the amount of money an individual or business pays for an insurance policy. Once earned, the premium is income for the insurance company. It also represents a liability, as the insurer must provide coverage for claims being made against the policy.

How to lower car insurance premium?

There are several ways you can do that. Have a look at the points mentioned below:

- Raise your voluntary deductible

- Choose only the coverage you need

- Compare car insurance online

- Refrain from making small claims

- Always quote the correct amount of IDV

What factors majorly affect car insurance premium?

Some factors that may affect your car insurance premiums are your driving habits, demographic factors, and the coverages, limits, and deductibles you choose. These factors may include things such as your age, anti-theft features in your car, and your driving record.

How is the car insurance premium calculated?

The car insurance premium is calculated based on the formula mentioned below:

Own damage premium – (depreciation + NCB) + Liability premium. And the premium for your car insurance depends on the below-mentioned factors:

- IDV

- Cubic capacity

- Manufacturing year

- Geographical location

- No claim bonus (NCB)

Remember that the IDV of a new car will always be the maximum, but it will gradually lower down due to depreciation.

Is your insurance premium a monthly payment?

A premium is the amount of money charged by your insurer for the plan you have opted for. It is usually paid on an annual basis but can be paid in monthly mode also. You must pay your premium to keep your coverage active, regardless of whether you use it or not.