Buying health insurance policy is in itself a task of responsibility. But should you select an individual plan or a family-floater?

Who doesn’t like to indulge in a family pack of ice-cream on a hot summer evening? Well, it is not just ice-cream, the concept of ‘family pack’ in itself is very lucrative. It is cheap and you get so much more. Ultimately, it is all about making things easier to plan and keep it easy on the pocket.

But when it comes to health insurance, why does it become so difficult to choose a family floater plan over individual plan?

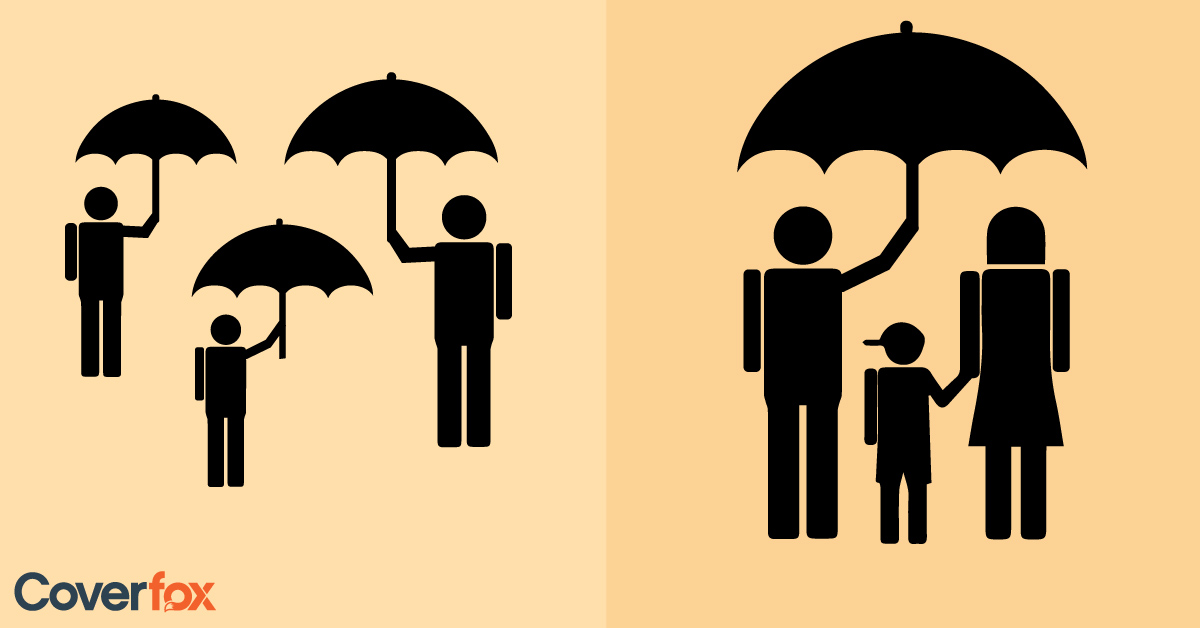

The point is, individual and a family floater plans find applicability in different scenarios. While a family will naturally prefer a family floater, a young adult or a young couple might consider to buy individual health plans. So let’s do a comparative-check.

Comparative Analysis

Coverage: An individual health plan covers one person at a chosen sum assured. While a family floater plan covers the entire family, including the spouse, (up to) two dependent children. Some family floaters even cover dependent parents. For instance, a family floater cover of Rs. 2 lakhs for 2 individuals of the same family will cover both the members. An amount up to Rs. 2 lakhs can be utilized by either of the members falling sick. In an individual plan of Rs. 1 lakh each for each member, all members will be able to use only up to Rs. 1 lakh for any claim.

Premium: Premium for an individual plan is determined based on the medical history and age of the individual buying the plan. In a family floater plan, the premium is determined based on the age of the eldest member of the group.

Renewability: After an IRDA mandate, most insurance companies offer individual health plans that are renewable lifelong without any limit on the maximum age of exit. Family floater plans usually have a restriction age beyond which members will not be covered. This restriction ranges from 60–70 years. Dependent children are also excluded from the scope of coverage once they attain 21 or 25 years of age. However, the health insurance providers offer the option to convert the policy to an individual policy.

Individual over Family Floater Plan

Individual plans scores over family floater plans in various departments. Let us locate it through the following situations:

Getting a separate cover for every individual is helpful in situations where family members might need medical attention in the same year as the family floater cover might be insufficient.

Under a family floater policy, there is usually a maximum age beyond which certain members are not covered. For instance, dependent children are only covered up to 21- 25 years of age. There is also a limit on the maximum age in a family floater policy. However, provisions are available to convert a family floater plan to an individual one, after the members listed in the policy outgrow the age bracket. Individual plans on the other hand are renewable lifelong.

Premiums charged in a family floater plan depend on the age of the eldest member. While in an individual plan, premium depends on the age of the insured individual.

Family Floater over Individual Plans

- The premium charged under a family floater plan is lower than that charged aggregately for separate members.

- These plans provide a larger cover as compared to an individual plan. The larger coverage with low premium generally works positively as the probability of all members falling ill in the same year is very less.

Our Verdict

Rather than oscillating between individual and family floater plans, why not have the best of both worlds. You could consider buying an individual health insurance plan for a small cover and another family floater policy. This will guarantee wider coverage with lower premium.