Mr. X has a health cover for his entire family – his wife, kids, aged parents. He has been very regular with his premiums. Yes, he is our very own Sanskaari 9 to 5 office goer, family caretaker that Bollywood lovingly projects.. And now his ailing dad is in the hospital – in the ICU and on the ventilator, which Mr. X insists should be kept with !

Since the overly careful Mr.X has always expected something like this to happen, he thought he was prepared for this and his efficient health insurance will let him do this without him having to rob a bank. But, nahiiiii! The doctor says going to be a long while before he comes out of the hospital, which is bad, but as long as daddy dear recovers well, but wait, here's where the bomb drops. The insurance companies refuses to reimburse Mr.X for his dad’s ventilator expenses!

Related Article: The claims process on your health insurance: A step-by-step checklist

This wasn’t part of the plan. Mr. X is shattered!

Because you cannot let this happen to you ever, we're going to explain just what happened in Mr. X's case and what is the deal with EXCLUSIONS.

About time you know what exclusions are

Exclusions are basically a set of conditions that you agree to not be covered at all or be covered in part, after a particular period of time. He has purchased a policy but did not pay attention to the part where it was clearly mentioned the policy did not support artificial respiration, especially when not advised by the doctor. Poor Mrs. X has no clue that she may have to sell her jewelry to pay those bills.

Related Article: Are Pre-Existing Conditions Making You Lose Faith In Health Insurance?

Now, you should know, exclusions are of four types:

Time related exclusion (waiting periods)

Non-medical expenses (registration charges)

Illegal reasons (drug.alcohol abuse, self-inflicting)

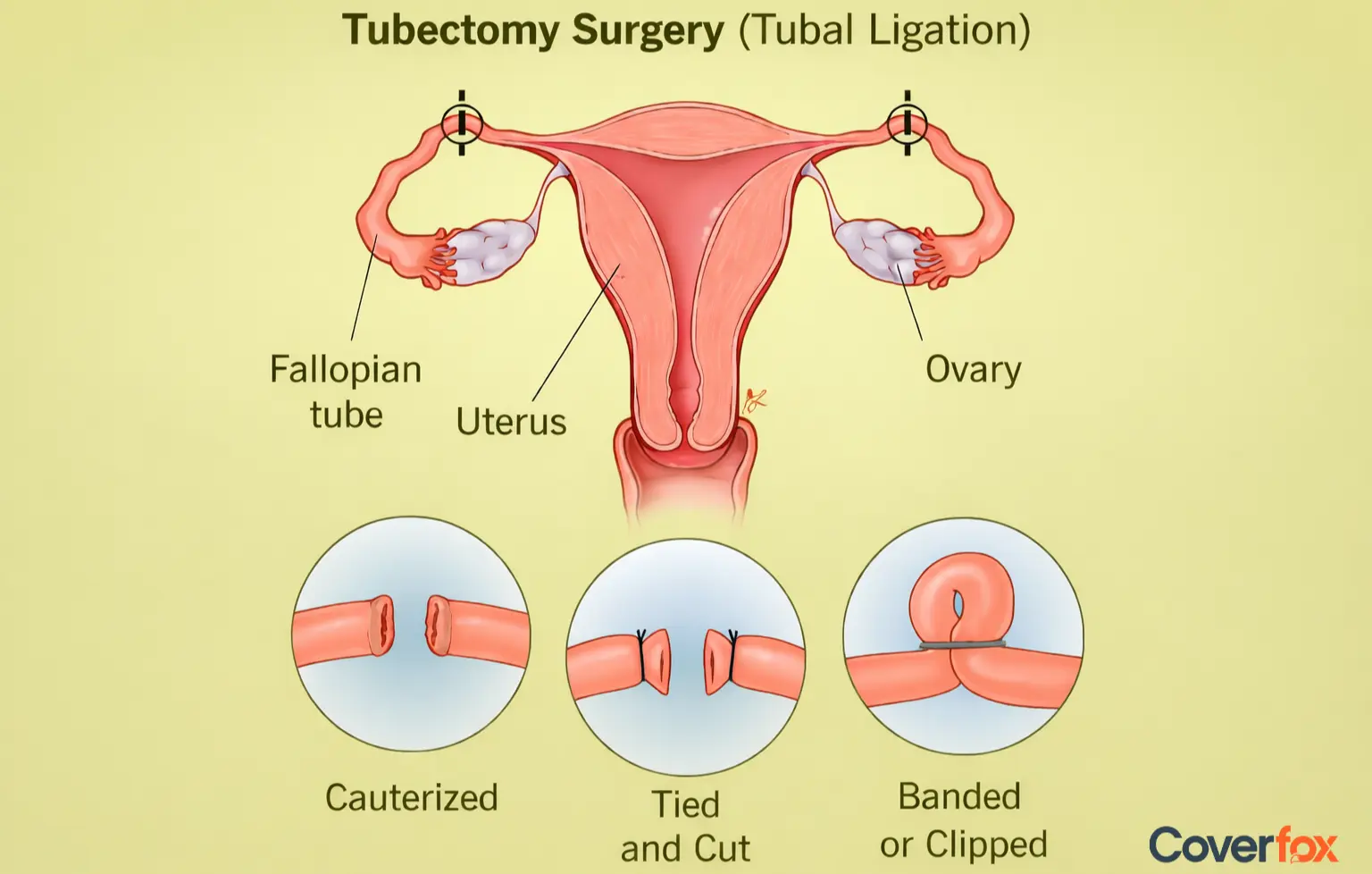

Out-of-scope (Unproven Procedures, Cosmetic, Maternity, Infertility, Psychiatric, Dental, OPD, Obesity, HIV, Adventure Sports)

Time related exclusions

Medical conditions that you may have, intentionally or unintentionally, at the start of your medical policy are called pre-existing conditions. Insurance companies cover such conditions on a time scaled basis. Some pre-existing conditions are covered only after completion of 2 years in the policy and some after 4 years. This period is defined as a waiting period in policy wordings (the document that you haven’t read fearing exclusions). Some diseases may not be covered at all – and this remains the insurance company’s call. These are time related exclusions. Sometimes, even conditions that arise from these pre-existing conditions are not covered. No, let’s not hate the insurance companies.

Non-medical expenses

Charges that you may incur for examinations (x-rays, lab tests) not connected to the ailment for which you got admitted in a hospital are not covered by health policies. Added to this, insurance companies also do not take responsibility of admission charges, registration charges, service or surcharges that’s levied on a hospital bill even though the other aspects of the admission are claimable.

Illegal Reasons

As desperate and sober that your reasons can be (no, seriously) trying to kill oneself (and others) is a strict no-no in our country; so, is alcohol and drug abuse (well technically they do qualify as self-inflicting damages). Insurance companies definitely cannot take responsibility for these choices of lifestyle and decisions - owing to which they do not support ailments that occur from such practices.

Reasons considered out-of-scope

There are some conditions that, however serious, do not get covered by the insurance company. Cosmetic surgeries, dental surgeries, hearing and vision etc are usually not covered. Some other conditions are pregnancy (unless you opt for a maternity specific policy, and even then it comes with a few riders and limits), war and crime related ailments, HIV, psychiatric, infertility, obesity and adventure sports. The reason behind this is that these are ailments and procedures occurring mostly out of choices willfully made by an individual. And the idea of an insurance cover is to protect you from situations that come unannounced, remember?

Exclusions are hate-able, we understand but here is why you should not

If we told you that exclusions are there for your benefit, you would..yes…scoff at us! But with a little patience, if you are still reading this and letting us tell you how, you’d know.

Health policies are continually being introduced so that more and more people have long term benefits. If these exclusions were absent, it would be very easy for someone who has any of these above mentioned conditions to buy a policy and make a claim with short term benefits in mind. When the insurance companies are challenged with such claims, though not exactly fraudulent, they handicap the insurers from making the health insurance system affordable, accessible and more profitable for other customers, sometimes more deserving and in dire need than this someone we just talked about.

Related Article: Inflation in health costs is your retirement party pooper. This is how top up plans can save you

So, go read those policy wordings that you have been procrastinating all along! It’s your policy and you should know what you might have to pay for even despite the policy.

If there is anything you need to know more in details about exclusions and waiting periods for your specified ailments, call us or leave your doubts here. We will clear them for you in a jiffy! There is no waiting period, we promise you!

Want to know more about the health insurance term & condition watch this video!

Frequently Asked Questions

How to buy new family health insurance?

Compare family health insurance policies online. For which, you have to enter the details of the family members with their age and pre-existing disease, if any. Then compare different policies with room rent, policy premiums, exclusions, waiting period, hospital network and so on. Once you fixed to a particular insurance company and the family insurance plan, make the premium payment. Once the premium is paid, you will receive digitally copy of your family health insurance policy.

What happens if the primary insured person covered under a family floater policy expires?

In case the primary insured dies post hospitalization then the claimable health expenses would be reimbursed. If the primary insured is also eldest member in the family, then for the succeeding years after the death of primary insured the premium would be calculated on the basis of the age of next eldest member. For this to happen, the family should fill up change of request form provided by the insurer.

Please note that in case there were only two members covered under the policy then the family floater plan would be converted to an individual plan.

Can I cancel my policy and if yes will I get my premium back?

Compare family health insurance policies online. For which, you have to enter the details of the family members with their age and pre-existing disease, if any. Then compare different policies with room rent, policy premiums, exclusions, waiting period, hospital network and so on. Once you fixed to a particular insurance company and the family insurance plan, make the premium payment. Once the premium is paid, you will receive digitally copy of your family health insurance policy.

Can a person have more than one Health policy?

Yes.