The health insurance industry has seen tremendous change over the past one year. Read all about it in the article listed below.

As per the Financial Express, ‘India is one of the least insured countries with only 20% of people having any kind of health insurance’.

As per Business Today, ‘the insurance penetration in India stands at 3.7% of the GDP in comparison to the world average which stands at 6.31%. The life insurance sector is growing at 11% to 12% while general insurance is growing at 18% per annum. For health insurance, the average growth rate is 35% per annum’.

A health insurance policy is the starting point of financial plans. The same is advised by financial planners. A health insurance plan is the first thing you should purchase before putting money into your investment goals.

With the new government in place, there has been tremendous potential for growth in the health insurance industry. But even after the successive measures taken by the Government of India, we still have a significant population which does not have adequate access to good healthcare.

In order to provide universal healthcare to the entire population, the Insurance Regulatory and Development Authority of India (IRDAI) along with the Government of India has introduced certain changes in the health insurance sector for 2019. The IRDAI has proposed to make health insurance more user-friendly.

Let us learn more details about the proposed health insurance changes for 2019.

Age limit and AYUSH treatment

To begin with, IRDAI has issued a draft for standard health insurance plan with basic sum assured of ₹50,000 to ₹10 lakhs. The draft defines the benefit structure applicable to individual insurance buyers with no upper age limit. Under this draft, the minimum age of entry for the principal insured is 18 years while the maximum age of entry is 65 years of age along with lifelong renewability. There is no maximum exit age.

The new basic standard health insurance plan will also have to provide cover for expenses incurred on treatment taken through Unani, Sidha, Homeopathy and Ayurveda systems of medicine. But the expenses are subject to fixed and standard sub-limits on the sum insured and the plan cannot be combined with critical illness cover or benefit based cover.

Shorter Waiting Period

A waiting period is the time period under which you cannot make a claim for a particular ailment. This is usually applicable for pre-existing diseases. As per the latest draft, insurance providers will not be able to prescribe waiting periods of one to four years for ailments such as cardiac conditions, hypertension and diabetes (lifestyle diseases). There will just be a cap of 30 days on the waiting period, unless these ailments are pre-existing.

Incontestable Post Eight Renewals

Keeping frauds aside, the insurance providers will also not be allowed to question claims on the grounds of nondisclosures at the time of taking the first health insurance policy after eight years of continuous renewals. This decision will definitely relieve some stress off the mind of the policyholder who has been consistent in premium payment.

Mandatory Coverage

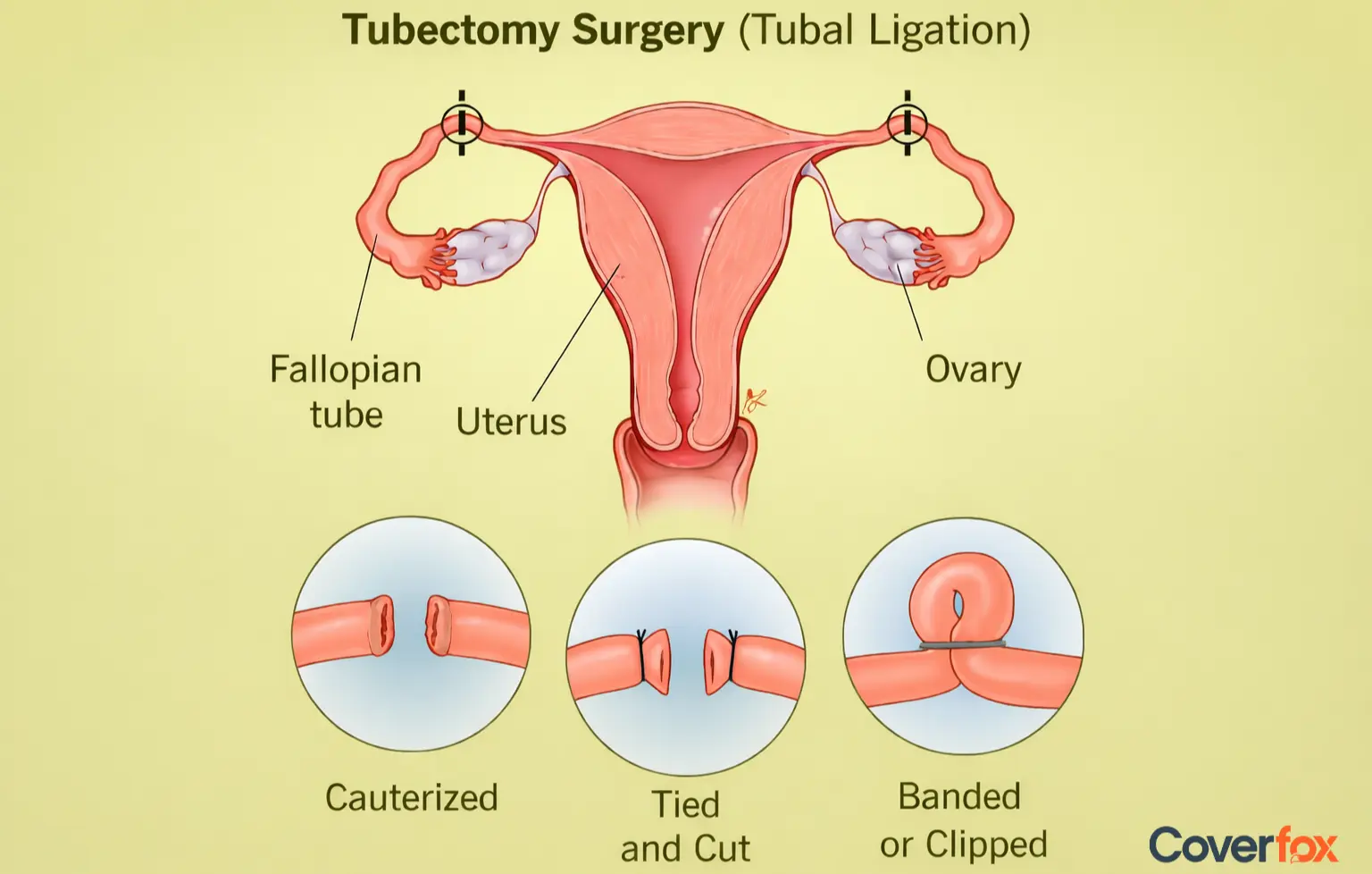

All health related diseases and ailments acquired post issuance of the health insurance policy will be covered and cannot be permanently excluded (except infertility and maternity). The list of exclusion comprises of ailments like Alzheimer’s disease, Parkinson’s disease, AIDS/HIV and morbid obesity.

Cover against Severe Health Conditions

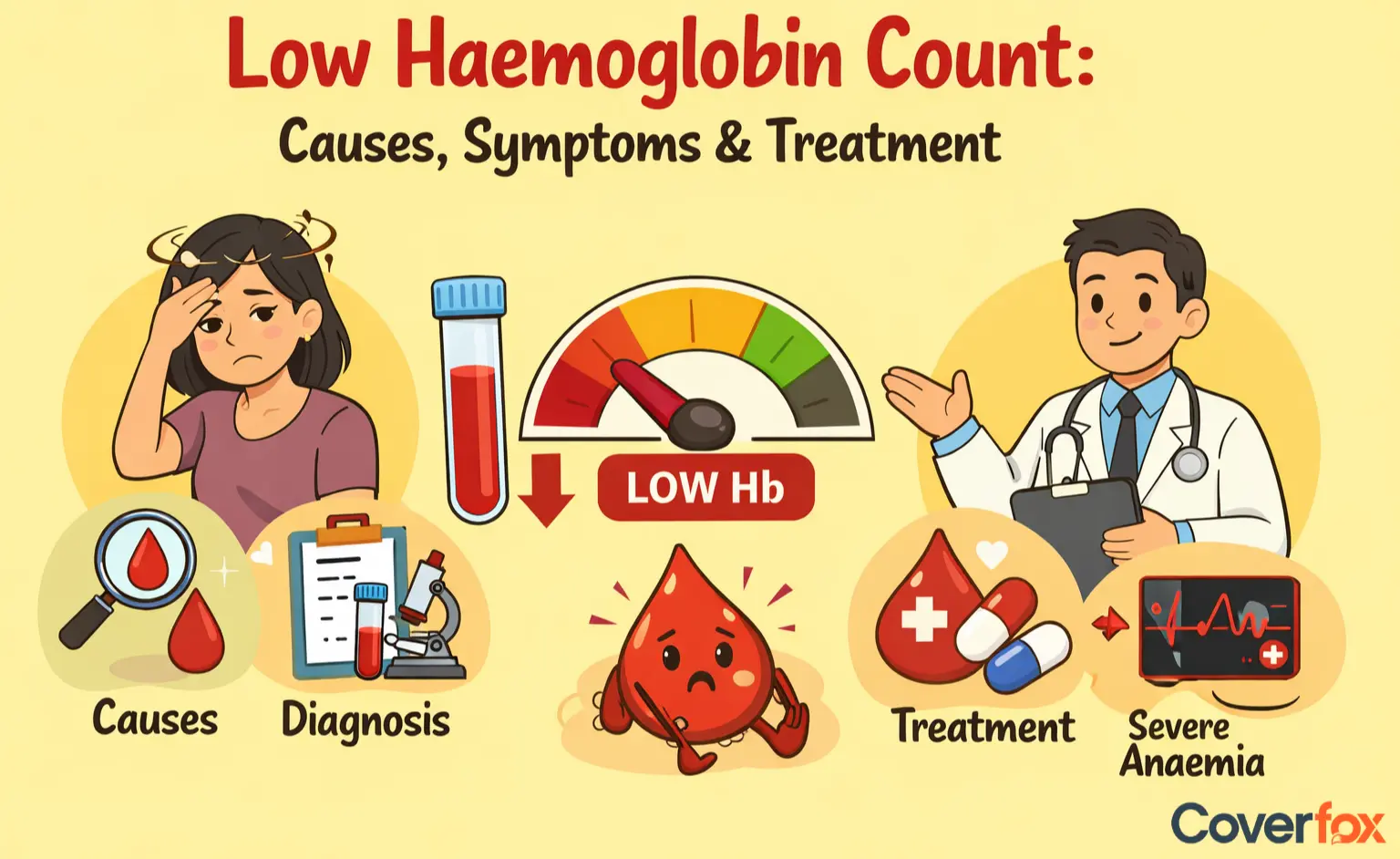

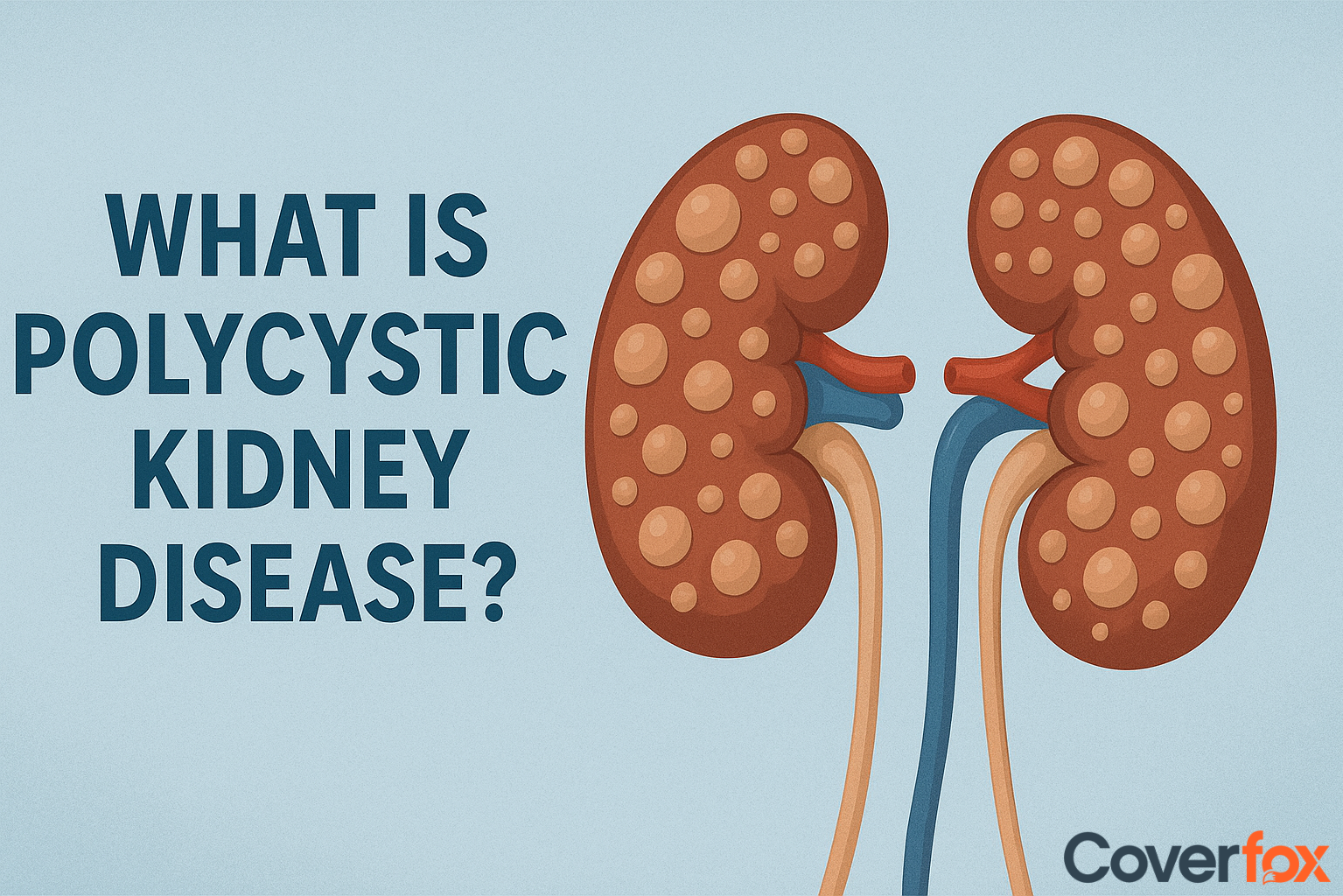

Earlier, people with physical disabilities, cancer survivors and epilepsy patients were denied health insurance cover even for unrelated ailments. Recently, IRDAI has stated that insurance providers will have to offer health insurance plans to such individuals (pre-existing diseases will not be covered throughout the policy tenure).

For this purpose, IRDAI has released a report which lists 17 conditions. It includes kidney diseases, chronic liver, valvular heart and congenital disease, HIV/AIDS. Conditions which involve a history of heart-related ailments and knee replacement will not be covered.

Clearer Definition of Pre-Existing Diseases

The IRDAI has told insurance companies to provide a simpler definition (Standardization) of pre-existing diseases to prevent any disputes over interpretation between the policyholder and insurer. The suggested definition is: any condition, ailment, injury or disease that is diagnosed before buying the first policy, for which medical advice or treatment was recommended by, or received from, a physician.

Cumulative Bonus (CB)

Sum insured shall be increased by 5% in respect of each claim free policy period, provided the policy is continuously renewed to a maximum of 50% of the sum insured.

Deductibles

No deductibles are permitted under the base cover.

Reportedly, IRDAI said "It is desired that the industry adopts a uniform approach while incorporating the 'exclusions' as part of product design as well as for the wording of the exclusions.”

For this purpose, IRDAI has set up a ten-member team, headed by Suresh Mathur, Executive Director (health) at IRDAI, to provide a detailed list of medical exclusions that are prevalent in current health policies. The committee will also keep in check certain exclusions which will not be allowed at all.

This entire course of action was accelerated by Delhi High Court’s decision which stated in February this year, that insurers can’t exclude genetic disorders and congenital anomalies, calling it a “violation of citizens’ right to health”.

A few objectives which the IRDAI aims to achieve through standardization are:

Rationalize the exclusions by minimizing the number to enhance the scope of health insurance coverage granted.

Provide a uniform approach for incorporating medical exclusions.

Standardize the language and wording used by insurers with respect to their ‘exclusions’.

Remove exclusions that disallow coverage with respect to new modalities of treatments and technologically advanced medical treatments.

- Study the scope of allowing exclusions specific to individuals with certain diseases.

Advanced Medical Treatment

IRDAI has requested for the formation of a Health Technology Assessment Committee. The function of the Health Technology Assessment Committee is to recommend inclusion of modern treatment procedures and drugs introduced in the Indian market.

Keeping all things in check, we clearly understand that the Government of India and IRDAI are trying their best to make health insurance more affordable and buyer-friendly. Coming to the point, it is in an individual's hands to purchase a health plan for themselves and their family. A health insurance plan is only going to benefit you in the future. Purchase a health insurance policy at a younger age, the younger you are, the cheaper the premium offered by insurers.

Recommanded: How to Shop for Health Insurance