Want to make a difference to the life of your poor domestic help? This article will give you some amazing tips.

In India, we are very fortunate that domestic help is easily affordable by the middle and working-class people. In first world countries if you need a domestic help then you need to be super rich but it’s not the case in India and sometimes I feel we are blessed in that way. Majority of households in India have at least one domestic help. Honestly saying we don’t value them much but even a single day of their absence disturbs our daily work routines and reminds us of their importance in our lives.

Our domestic maid has no paid or sick leaves, provident fund or job security. This sector is an unorganised sector. It is very hard for these low wage earners like domestic helpers with inadequate financial resources to plan and lead a good life.

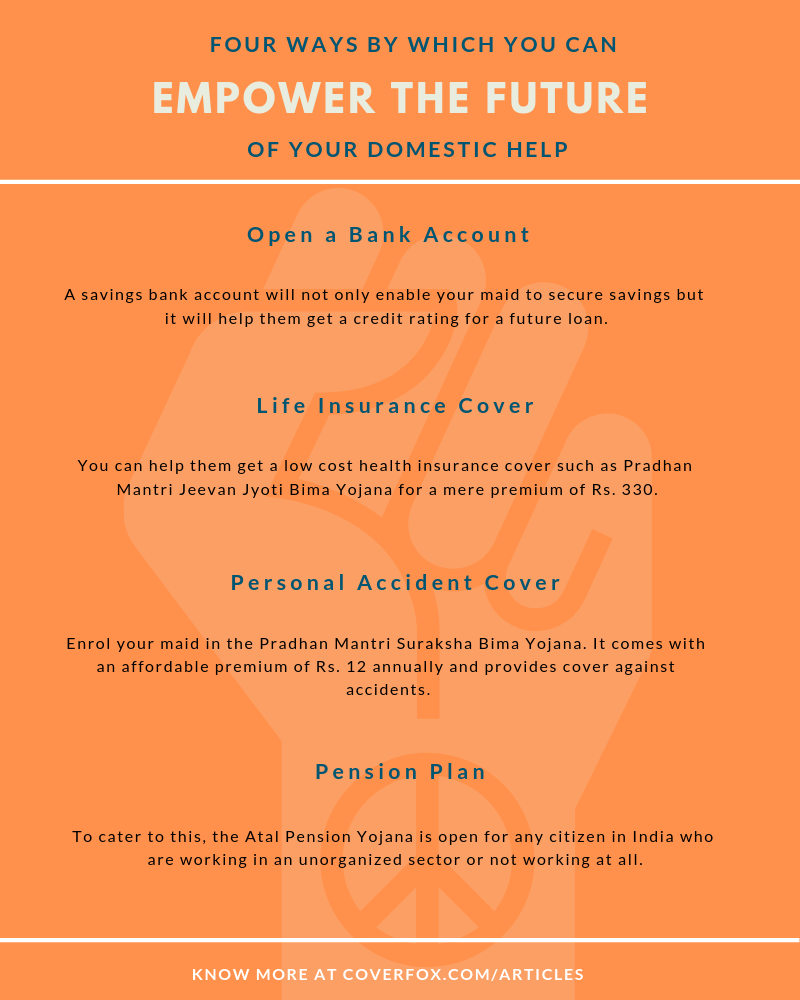

So, the question is, can we help them to become financially secure at least to an extent? Let’s see the few simple things that have been outlined below which can make a big difference and empower the future of your domestic help.

Advise them to open a Savings Bank Account

Thanks to the government initiative and push to use technology and offer incentives like LPG subsidy and other benefits, most of the low income families now own at least one bank account. If your domestic help still does not have a bank account then encourage and insist them to open one at the earliest. Educate them on the benefits of having a bank account and how to use debit card and cheque book for secure money transactions. A basic saving account like Jan Dhan account will be a good suggestion. This one step alone will help them with three major benefits:

- They will have access to government benefit schemes and offerings.

- It will help them save money in a secure place away from their life partners who may spend the money callously on drinking, smoking and chewing tobacco.

- It will also help them get a credit rating and access to official and recognised bank loan rather than borrowing money from local money lenders who charge an insane amount of interest.

Suggest them to get a Life Insurance cover

Having a life insurance is a must for everyone and government has taken measures to introduce low cost life insurance cover like Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

To have access to this life insurance cover you need to be between the age group of 18 to 50 years and have a bank account. You can get your domestic help to buy this plan and link it to her savings account.

The plan provides a good sum assured of INR 2 lakhs life cover for a very nominal premium of INR 330 annually. The sum assured is payable to the nominee on death of the policy holder be it natural or accidental.

You can also suggest a Personal Accident Cover

As domestic worker, the physical work is often exposed to a number of situations which can result in an accident such as tripping on a wet floor or falling from a height. Any accident may lead to loss of job or earning permanently or temporarily. Hence, getting a standalone Personal accident cover is very important.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) with an extremely affordable premium of INR 12 annually covers the injured against disability and accidental death. For full disability the coverage amount is INR 2 Lakh and for partial disability the coverage offered is INR.1 Lakh.

The policy is available only through a savings bank account.

Pension Plan

Pension might be a bit complex to explain to your domestic help. Nonetheless, explain them the benefits of buying a pension plan and how it will help them in later years of life.

Atal Pension Yojana (APY Scheme) is open for any citizen in India especially for those working in unorganized sector or not working at all.

It offers a guaranteed minimum pension from INR 1,000 to INR 5,000 per month from the age of 60 years contingent on the contributions made. The age to enrol in this plan is between 18 years to 40 years and minimum duration for this plan is 20 years. For example - A 35 year old individual has to contribute INR 902 per month, to get INR 5,000 per month pension amount. The contributions period is for 25 years (60 years minus 25 years age).

In case of death of subscriber, pension will be paid to the spouse and on the death of both of them (subscriber and spouse), the pension corpus will be returned to the nominee.

If you give bonus to domestic help on festive season or on a special event do strongly advise them on the investment options. This will help empower the future of your domestic help in getting some financial benefits and freedom for the otherwise thankless job and vital contributions they make in our lives. As it is said every little helps, go ahead and do your good deed and you may get good returns on your good KARMA!

Check out these super easy ways to empower your domestic help's future.

.jpg)