Want to be married happily ever after? See how life insurance can ensure that dream for you!

A wedding is an event but marriage is a lifelong event for most people in which both partners are dependent on each other. If something happens to one partner it can be disastrous emotionally and financially and to protect from this risk, adequate life insurance coverage is required. It is unfortunate that still a large part of the Indian population is not insured due to lack of awareness about importance of having a life insurance coverage. The harsh truth is that life is full of uncertainties and in case of sudden demise of one partner, the surviving spouse faces severe financial misery if insurance is not taken.

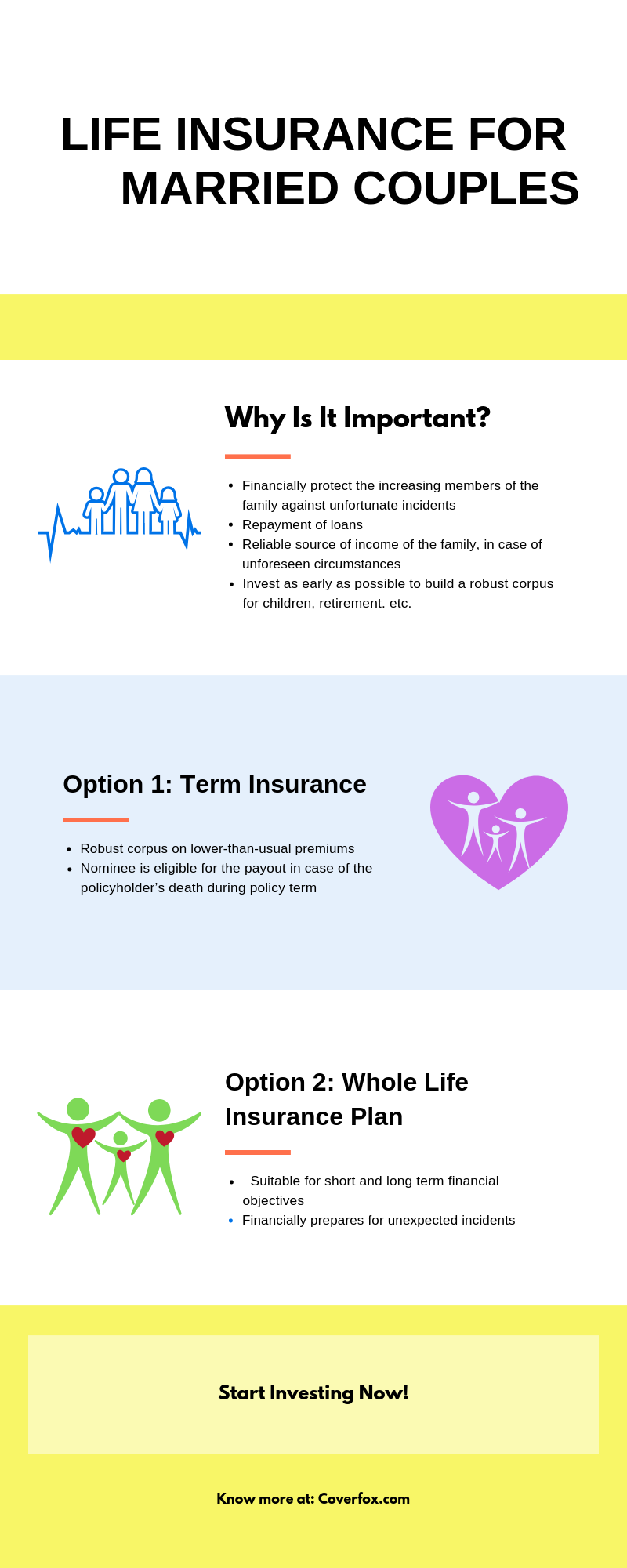

Let’s dig out the importance of life insurance for married couples.

Sudden increase in expenses after marriage and Income replacement

Once married, there is a sudden increase in expenses as there is a big difference in living a bachelor’s life and married life as number of dependents increase i.e. your spouse and children. Loss of income due to an unfortunate event can be disastrous A life insurance plan helps in replacement of income in case of an eventuality. It also provides protection against current lifestyle in case of any unfortunate incident.

Loan repayment obligation

As mentioned in the above point, married couples may take big loans to buy house, car etc. In case of a sudden demise of one partner the entire loan repayment obligation will suddenly come on the other. With single income it would be impossible to pay house loan and the financial pressure will be too much to sustain. Thus, you may have to forego the home which is a basic necessity for a human being. Life insurance can give you protection against such big loans to cover against devastating possibilities.

When should a married couple get Insurance?

Most people get hitched in their mid to late 20s or early 30s. At this age no one thinks about dying and they are living high on life and insurance is the last thought on their mind. However, the cost of life insurance only increases with age. The life insurance premiums payment is lower when a person is younger. The reason being morality rate amongst young adults is lower in comparison to mature or older people. Young people are also free from lifestyle diseases like blood pressure, diabetes or any other critical health conditions making them less risky to insurance companies for putting an early claim. This in turn allows insurance companies to offer higher coverage to young adults for lower and affordable premium rates. Lower premiums make it easy for young couples to pay the expenses and at the same time acquire financial protection in the form of life insurance.

Life Insurance product options for married couples

Term plans

Term plans offer high sum assured at affordable premiums and are the best option to cover huge debts which married couples take to kick start their married life. Terms plans also offer various useful riders which can be attached to the base plan for extra premium. The benefit pay-out is given on demise of the policy holder to the nominee. Term plans offer long term protection for low premium without maturity benefit. Today you have a number of term plans offering joint life cover to both the partners under a single plan. However if both the partners are working then it is best to get individual term plans otherwise you can extend your term plan to your homemaker spouse and secure your lovely family.

Traditional insurance plans

Traditional or whole life insurance policies are good options for married couples. These plans cover the whole life of an individual and are good way to build savings over the years. The policies can also be used to meet short and long term financial goals. Loans can also be availed under these policies to meet any urgent financial requirement. Although these policies are expensive, they offer guaranteed amount at the end of the term. Getting life insurance policy is also like an expression of care that you want your partner to be protected in the case of an unfortunate event. It is best if the importance of life insurance is realised early rather than later in life. So, get a life insurance today and ensure your peace of mind!

Read on to know what married couples look for while buying life insurance.

.jpg)