The work done by housewives is always undervalued and thus, taking life insurance for them is considered a waste. Read on to know why life insurance is a must for housewives.

.jpg)

Life Insurance is always meant to provide stability to a family on the loss of the bread earner of the family. It is very important to insure the life of the earning member so as to protect the family from any financial setback if a mishap happens in the family. In India, we still believe in the patriarchal system where a man is considered to be the earning member in the family and mostly the lives of the male members are insured. But, with changing times, it has become equally important to think about life insurance for housewives as well because she might not be earning the bread, but she surely performs duties which are vitally important.

Duties of a Housewife

We can enlist a few of the tasks that a housewife performs which are imperative in nature.

1. Household Management

The term ‘Household Management’ precisely means all tasks related to the smooth running of the house. It can be purchasing of groceries, stationeries or the school supplies for children. It can also be visiting post offices, banks, laundries, paying bills, arranging for maintenance or any repairs needed in the house etc.

2. Childcare

The most important task of a housewife is to take care of the children. Generally, many ladies prefer to become stay at home moms, only to take care of the children. When it comes to childcare, it includes feeding the children on time, drop at and pick up from the school or the bus stop, looking after their studies or extra- curricular activities, taking care of their medical procedures like visiting the doctor or the dentist etc.

3. Cooking and cleaning

Cooking is one major task of housewives. Good and healthy food is the key to a healthy family. So, a housewife always makes extra effort in preparing food for her family. Along with that, clean surroundings are also a mandate for a healthy family. A housewife also has the responsibility of taking care of the cleanliness and hygiene of the house in order to maintain the healthy atmosphere around the house.

4. Budget Maintenance

She is the book keeper of the family. A housewife will develop the budget for the family. She will maintain as well as oversee the budget and scrutinize if any changes are to be made in the budget. She has the responsibility of keeping track record of any big or small expense within the house, and allocation of the financial resources needed in the home.

5. Jill of all trades

Basically, a good housewife is considered to be a Jill of all trades. She is expected to do each and every task starting from minor repairs, carpentry, co-ordination with people needed for this maintenance etc.

All these chores within the household are extremely important for the smooth functioning of the house. But even after handling and managing all these chores and smoothly running the household, women who prefer to stay at home and are housewives are treated in a negligent way in our society.

However, the loss of a housewife in a family can not only have an emotional impact, but can also result in certain disturbances in the household budget as well. This is because there would be need for external help or a care taker for performing all these duties which is going to be quite a hefty expenditure for the family. It is necessary to have life insurance for housewives, so that the amount obtained can be of some benefit to their ailing families. This can be a very crude way to evaluate and assess someone’s worth, but it’s quite an important topic to have a practical outlook.

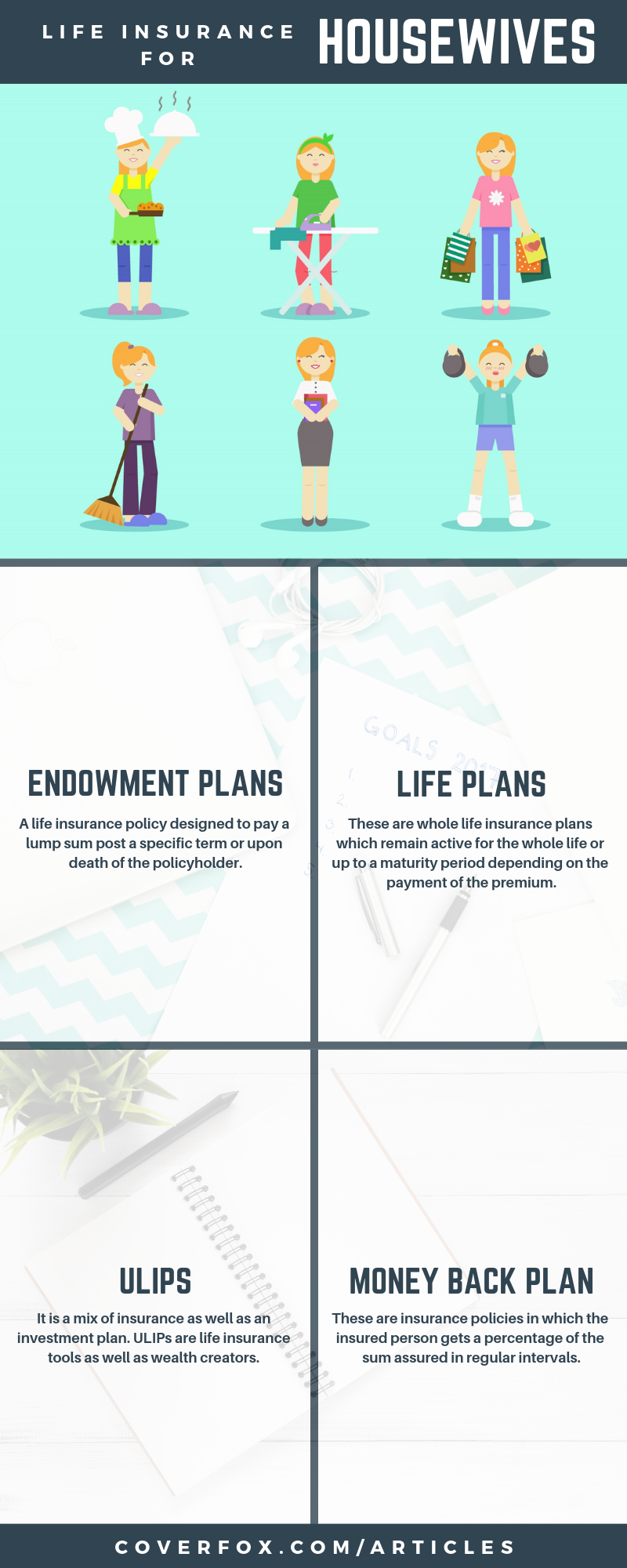

When it comes to insurance for housewives, there are not many options and many Insurance companies do not entertain this idea. The term insurance plans are usually available for earning members; however, we can list down a few insurance options for the housewives as well.

Insurance Options for Housewives

1. Endowment plans

These are the insurance policies where the policy holder is insured for a specific period of time. Upon maturity, the insured person will receive the assured sum and if any additional bonuses that he/she is entitled to. Also, in case of demise of the insured person, her nominee can claim the sum assured and the bonus. These are low-risk plans and provide tax benefits with them.

2. Whole Life Insurance plans

These are the whole life insurance plans which remain active for the whole life or up to a maturity period depending on the payment of the premium.

3. Unit Life Insurance Plans(ULIPs)

It is an ideal option for housewives as it is a mix of insurance as well as an investment plan. A part of your investment is put into use for life insurance and the remaining is put into a fund which can be of future use to you. So, ULIPs are life insurance tools as well as wealth creators. Moreover, ULIPs can be used to claim tax deductions.

4. Money back plans

Money back plans or policies are those insurance policies in which the insured person gets a percentage of the sum assured in regular intervals, rather than getting the lump sum amount at the end of the plan term. These can be helpful for housewives as they are a regular source of income and can be useful in fulfilling long term financial goals.

Furthermore, there are some insurance policies which are exclusively designed for women and can be purchased by the housewives. These policies have minimal premiums and provide the essential coverage needed.

This policy provides life insurance to those housewives whose husbands have purchased the term policy of the company online. There is a ceiling of Rs. 1 crore and covers would be of over Rs. 30 lakhs which is to be provided after a series of medical check-ups and examinations.

- HDFC Life Smart Woman ULIP

This policy covers certain vital events in woman’s life like giving birth to a baby or the unprecedented death of spouse. Also, this policy has provisions which allow women to stop paying premium for three years in case they have a complicated pregnancy, they have a baby born with congenital diseases, they have malignancy in any female organs or the death of spouse etc.

- Tata AIG’s Wellsurance Woman

In case of diagnosis of any of the specified 11 diseases which include heart attack, cancer, kidney failure; the policy will entitle the insurance holder to get a lump sum amount. Also, the insurance holder can get daily cash benefit in case of hospitalization.

- Bajaj Allianz’s critical illness cover

There are almost 8 women specific illnesses which are covered in this policy. Illness related to paralysis and cancers are also included in this category.

There are certain limitations on the amount of insurance coverage a housewife can get i.e. between Rs. 10 lakhs to Rs. 15 lakhs. Also, many –a-times, it depends on the insurance of the earning spouse as well.

Hence, with changing times being a housewife is not a matter of compulsion anymore; it’s a matter of choice now. Along with this change in time, change in the mindset of people is also needed to establish a healthy society where housewives would be considered no less than their spouses and their worth would also be the same as that of their earning partners.

Here are the different kinds of life insurance products that are apt for housewives.

.jpg)