Each time I think about the big THREE OH! approaching, I think of Rachel from F.R.I.E.N.D.S when she wakes up on her birthday morning, realizes she is 30 and decides to take all her big pending decisions.

.jpg)

Well, I’m not Rachel nor am I thirty (I’m aware I have a couple of years to account for it, ThankYouVeryMuch)! When the twenties die on me, I would wake up probably feeling a lot more depressed than she was and certainly don’t want to be the one waking up to an unfulfilled wish-list.

Today, after having seen a few unfortunate events in the friends and family circles, I have wondered about how safe and protected one can ever really be. Obviously, you can never be careful enough nor can you guard your loved ones enough. Without having to put some morbid thoughts in your mind, can I prompt you to make a mental picture of a future without you in it? No, we are not talking about how many would miss on Facebook. We are talking about practical life decisions that will save your family a lot of trouble, when time and tide are not in your favor.

It might sound unpleasant but it has to be said: Life insurance is NOT about dying. It’s about being able to take care of your current and future financial liabilities, if and when something adverse was to happen to your life.

If you thought you don’t need life insurance when you are young, you cannot be more wrong!

You think that being in 20s is hardly a time to worry about life insurance and your liabilities. This just in (not really)- There is no predetermined or perfect age by when you should take life insurance. Like health insurance, the sooner you take a life policy, the better for you. In your 20s and 30s, you are statistically bound to have far lesser health complications, or chances of life threatening risks than what you may have at 40 or 50. Thus, in your decision to take a life insurance policy, you will pay a low premium which is not possible as you grow older. The risk of age related health problems counts upward with each growing year and the premium at such a later stage is bound to be far more than what you have to pay today! You can surely afford to go out for a nice meal at least twice or thrice a month. When a life insurance policy costs you the same, what stops you from spending on it, my friend? If you still think you only need it later in life, you have to keep reading.

What’s a higher premium when you are going to be earning in 6 figures and driving your dream car, you think?

Even if you are single now, in a couple of years (or if you’re a commitment-phobe, then fine, more than a few) there IS going to be a family in the picture? A cozy 4 BHK house in a nice locality where your kids wouldn't have to share their bedroom with their ageing grandparents, a shiny car on your driveway and the whole paraphernalia. Yes, very cute. Earth to you, firstly. And secondly, you can afford THAT, so a life insurance premium should be easy-peasy. No? Car, home loans and kids’ schooling is costing you a bomb? Oh and your parents – you cannot compromise on their well being. After all, they never compromised on yours, with far lesser than what you have now! Now, you see the bigger picture! Minus all frills and fancy from the future you, the premium on your life insurance is a very small amount you pay today, to lock your security and protection for all those years ahead of you, when you know you’d be providing or contributing to a happy family!

Tomorrow, you are older by a day, and not the same person you are today. For all those futuristic years of building this hunky-dory future, I hate to say it, but you may even pick one or few of the many, many conditions that are considered a pre-existing ailment. And over that reason, just your luck, they can not only load your premium, but even deny you a policy! Then follows the usual questions - What If? And What Next?

The policy that you signed for not too long ago was probably the most important decision you have made in your life so far, unknowingly!

If you have a policy, thanks to your over-cautious dad or forever-nagging uncle, then I can effectively say that your task list for the 20s is lighter than most others. But if you thought it was cool to have a life policy only for its tax benefits, you-just-got-judged! Life insurance is what protects you and your loved ones from your current and future liabilities and choosing a policy for its tax benefits alone would just make it the prime contender for dumbest-move-ever-made. The loans you have taken will still continue to haunt your loved ones, even when you are gone. So it is important that you DON’T see insurance as an investment, and that you see the tax benefit in a life insurance policy in a holistic manner.

And now that you know how this works, you realize that the policy you were made to take isn't what you are interested in; it’s not too late to make a comparison of the policies available in the market. Yes, there are that many options available – you didn't think you are the only one wisening up here, did you? Which is why there are people like us at Coverfox, where we can listen to your success story of how this realization changed your life completely, AND help you choose what’s best for you!

To sober you up with some hard-hitting questions, what will become of the lovely wife or caring husband? Will she or he be able to single-handedly earn for the family, take care of those pending loans you leave them with and protect your children’s’ future from taking a hit? What becomes of your parents? I can choose to not be this hateful person and sympathize with your procrastination for today, cheering to your youthfulness over a couple of drinks, but we’d both end up just plain wrong, then! So don’t lose any more time than you may already have! You know the drill and you know how to do it. If you don’t, there is Coverfox to sort you out!

PS: For all those nasty stuff I put in your head, feel free to ask me heart-wrenching insurance questions as pay back, right here, right now! :)

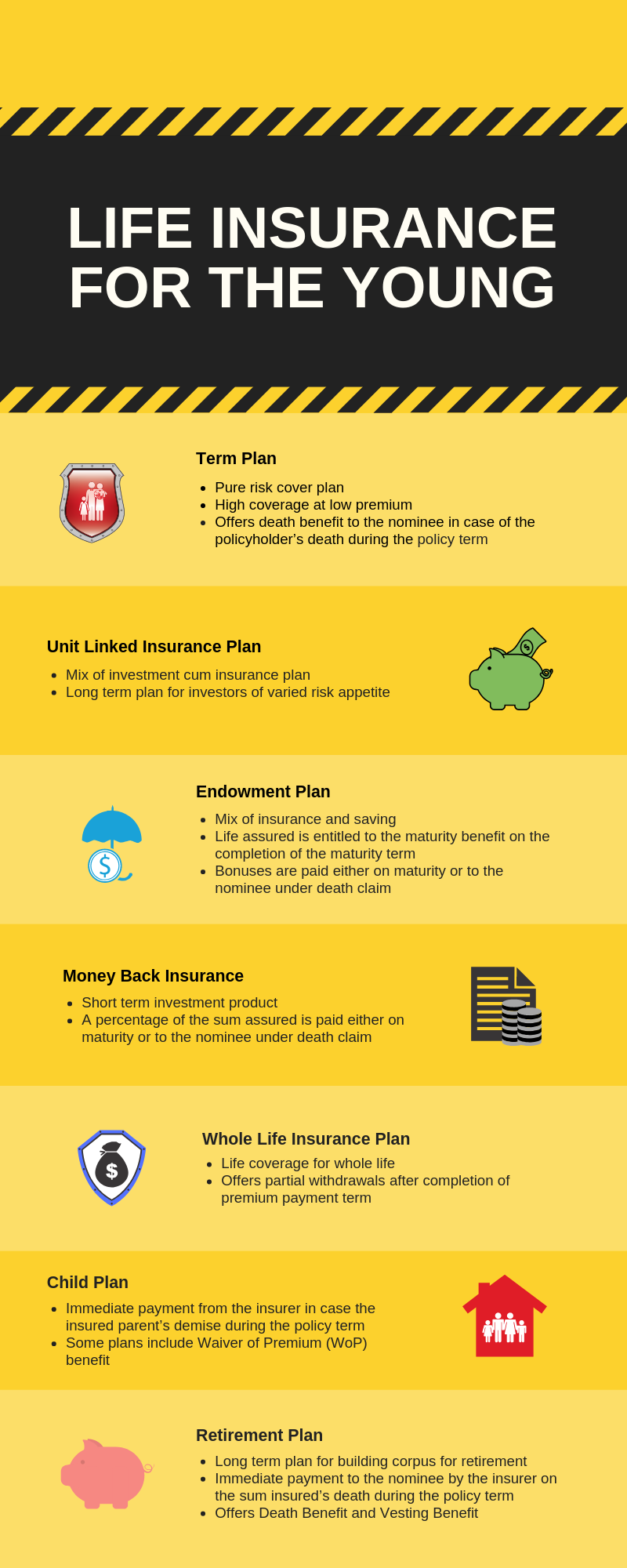

Here's a quick read on how each life insurance product benefits young people.

Recommended Read: How to Select the Best Life Insurance Policy

Recommended Read: 7 Reasons Why Singles Need to Buy Life Insurance