Know the primary differences between life insurance and accidental death insurance if you are confused between the two!

Life Insurance

The life insurance sector has blossomed over the past few years in India. There are many diverse products, each with a variety of offerings. Right from a life protection cover to meeting different financial goals, life Insurance plans come with many objectives for the policy holder. Here are a few basic types of covers, including whole life and term insurance policy.

Endowment policy

These policies are meant for people who want return on their investment. These plans come with a specific maturity period. If the policy holder dies due to an occurrence of any unforeseen event, the sum insured will be received by the nominee and the policy will end. If the policy holder survives the term then he receives the agreed maturity benefit along with the accrued bonuses, if any.

Term Insurance

This is a pure death risk plan covering a specific term. If the policy holder dies during the term the nominee gets the sum insured. There is no maturity benefit under this plan. These plans offer a huge sum insured for low premium.

Moneyback plans

In these plans a percentage of sum assured is paid on periodical basis as agreed. The plan covers life risk for the entire tenure and for the full amount irrespective of the benefits that have been paid out.

Whole Life Insurance

These plans give you lifelong protection and there is no specific term attached to the plan.The policy stays in force throughout the life as long as the life assured pays the premium. Usually, the maturity age is 100 years. If the life assured dies before the age of 100 years, the nominee receives the sum assured. However, if the life assured outlives the age of 100 years, the insurance company pays the matured endowment coverage to the life insured.

Children's policy

Financial planning for your child's future needs at the right age is a sign of successful parenting. Here in comes the role of child plans that are taken to fund future expenses for children to cover milestones or achieve life goals. It is the best gift you can give your child.

Annuity Plans

These plans help cover income loss after individual retirement or when regular source of income has stopped. They aim to provide financial independence to insurer in the autumn years of life.

Accidental Death Insurance

Accidental Death and Dismemberment Insurance, or AD&D Insurance protects you and your family if you get seriously injured or die due to an accident. The policy is designed to provide financial benefits if you die or lose a limb, suffer blindness, or even get paralysed due to the cause of the accident.

This type of coverage can be acquired with no medical test. Since this coverage provides limited form of life insurance (which covers only accident insurance) the monthly premiums are less.

Life Insurance and Accidental Death Insurance Difference

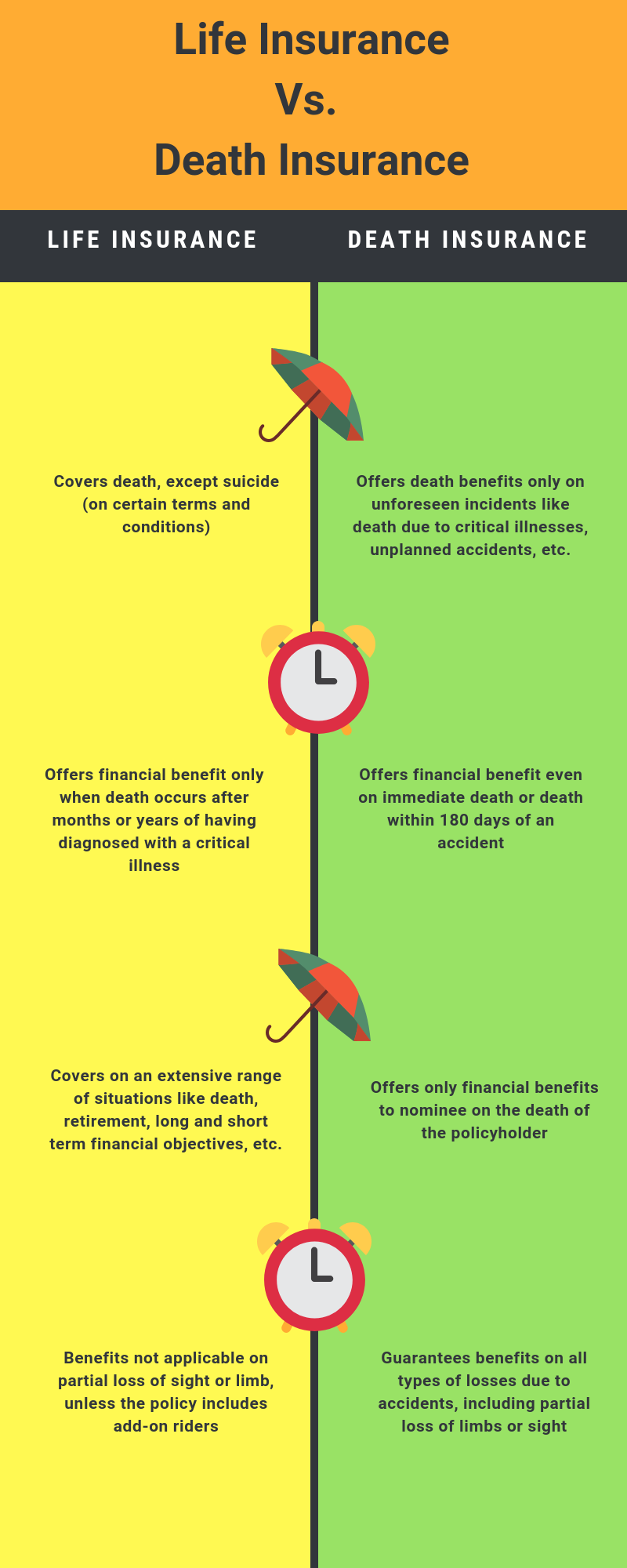

Cause of death covered

Life Insurance plans provide financial benefit covering all causes of death excluding suicide (which may be covered after waiting period). Accidental death insurance provides financial benefit covering death exclusively caused due to an unforeseen and unfortunate accident.

Death condition

Life insurance provides death benefit even if you die months or years of getting a disease or illness. Accidental insurance provides benefit if you die instantly or within specific period of an accident usually 180 days.

Variety in plans offered

Life Insurance has variety of plans that covers individual requirement like death cover, short and long term financial investment goals, retirement solutions, etc.

Accidental Insurance as the name suggests covers only accidental situations offering financial benefit to nominees.

Partial benefit

Life insurance does not give financial benefits on partial loss of limb or sight unless you attach a rider to the base policy. Accident Insurance gives out financial benefit if the policy holder suffers from loss of sight or limb due to an accident.

Comparing Life Insurance VS Death Insurance Pay-out

| Life Insurance | Accidental Death Insurance | |

| Death from disease or illness | Yes | No |

| Death from an accident | Yes | Yes |

| Death from overdose of drug | No | No |

| Financial benefit for Loss of limb, sight, hearing, etc. | No | Yes |

Thus, chances of dying from an illness are much more than the chances of dying from an accident. Accidents are ranked number 8 after heart disease, cancer and chronic lower-respiratory diseases etc on causes of death in India according to 2016 data from Institute for Health Metrics and Evaluation.

And if you die from an accident but not instantly or after the specified period, your nominee might not get any benefits. To get accidental death insurance benefit it must be proved that death was directly caused due to an accident and within the certain time frame. Accident insurance excludes death due to high risk adventure activities like sky diving, motor racing and has other exclusions like a drug overdose, drunken or drug-impaired driving by the insured person, war, complications from surgery, mental illness etc.

Conclusion:

If your aim is to provide financial safety for your family then life insurance is the right purchase. Accidental insurance can be taken as a supplementary policy on top of life insurance policy. Some life insurance policies also offer accidental death benefit as a rider which can be attached to the base plan for an extra premium. The overall idea of having an insurance is to have adequate financial cover at all times for you and your family, so choose your insurance cover wisely.

Here are a few differentiating factors between life insurance and death insurance.

Recommended Read: Personal Accident Insurance vs Term Life Insurance

.jpg)