ULIP is no more a costly investment product. Few ULIP plans are far better than investing in mutual funds. Read all about investing in ULIP with lower cost.

The Unit Linked Insurance Plan (ULIP) is a type of life insurance product with an investment component. You can opt for ULIP plans to build a capital for future financial needs. ULIP provides a life cover to the investor and an opportunity of investment.

But, investors of ULIP suffered in 2008 when stock markets went down drastically. People rushed to surrender their ULIP policies. However, were punched in their face, when found out that surrender charges were too high to bear the losses. And so were the premium allocation charges, which were deducted from their premiums.

Because of such number of charges and the higher rates of each charges, the amount invested were low, and the returns were far too lower than expected, making ULIP not a good financial vehicle for an investment.

However, post 2010, the regulations were changed.

ULIPs Have Changed After 2010

Post 2010, ULIP charges were lowered. And the lock-in period in ULIP was changed from 3 years to 5 years.

Prior to 2010, the surrender charges in ULIP were 80-90% of “fund value” and varied depending on the year of surrender of your policy term.

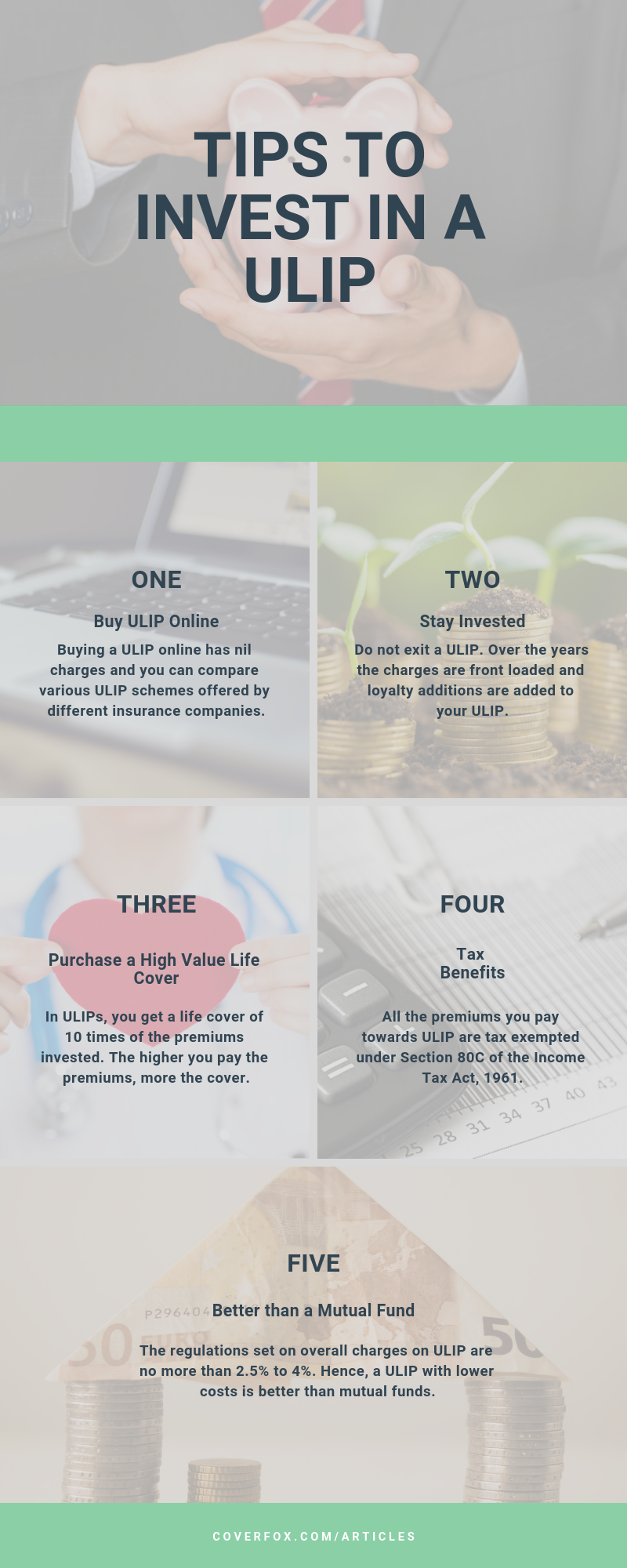

However, after changes made by IRDA in 2010, there are no surrender charges after 5 years since the inception of the policy. And the overall charges in ULIPs that can be charged came down to around 2.5% - 4%.

The overall charges in ULIP further reduces to NIL - 2.35% if bought online.

ULIP is better than Mutual Fund

Yes, you read it right.

Because of online purchase of ULIP plus, the stringent regulations set on overall charges on ULIP not to be more than 2.5% - 4%, have made ULIPs with lower costs better than mutual fund.

Few online ULIPs available in the market charges even below 1%, however, these may differ with the premium, policy tenure, age, etc.

ULIP and Mutual Funds share few similarities. Like in mutual funds, you can invest in small-cap, mid-cap, or large-cap, in ULIP you can invest in different funds as per your risk appetite.

Let’s see how you can gain better monetary benefit in ULIP with lower costs than in mutual funds:

For instance, if someone at the age of 30 years invests a sum amount of Rs.35, 000 annually in an online ULIP for 15 years of term, at the end of the policy term, the amount accumulated will approximately be Rs.8.5 lakh with the assumption of 8% return. This comes after removing the overall charges of around1.3% including premium allocation charges, mortality charges, and other charges.

Why such online ULIP with lower costs are more advantageous?

Since new ULIP offered by insurance companies have a five-year lock-in, wherein earlier it had a three-year lock-in. This way, the charges are distributed over the period of 5 years, instead of 3 years. Therefore, the money invested is comparatively higher than the earlier plans.

As the new plans have 5 years of lock-in period, the portfolio manager can plan and invest accordingly. Because, the investor will be investing for 5 years, this gives them funds to allocate accordingly.

Let’s see if someone invests the same money in Mutual Funds:

If he invests the same amount of money in a top rated mid-cap fund or even in a large-cap fund, he will receive approximately Rs.7 lakh in 15 years (at 8%). Because the average expense ratio of top mutual funds is nearly about 2.6%. **Moreover, you get a life cover when you invest in a ULIP, which is like a whipped cream over coffee.

**Going further, how you can reap the most out of ULIP with lower charges?

3 Best Tips to Invest in ULIP with Lower Charges

Tip 1 to buy low-cost ULIP: Buy ULIP Online

These days you can buy ULIP directly online. All life insurance companies offer ULIPs online.

Why buy ULIP online? Ah! The most interesting question I always love answering.

- Online ULIPs have far…far lower or close to NIL charges as compared to buying ULIPs offline.

- Before buying ULIPs online, you can compare different ULIP plans offered by various insurance companies.

- You can simply compare on the free ULIP comparison tool provided by Coverfox.com to get the best plan for yourself.

Advantage of comparing ULIP online:

- Compare the sum assured of different ULIPs – the amount of sum assured for the same premium

- Compare charges – premium allocation, Fund Management, surrender charges, etc.

- Compare returns – returns at the end of the policy tenure.

Tip 2 to buy low-cost ULIP: Invest for at least 10+ years

The lock-in period in ULIP is 5 years. That means, you must stay invested in ULIP at least for 5 years. You can easily exit from ULIP after lock-in period ends.

But…do not!! Do not exit ULIP after 5 years. In case you need emergency funds, you can opt for partial withdrawal. But do not exit ULIP.

Do not stop paying premium till maturity. Though, the surrender charges are low, you will still face the blow.

Plus, ULIP is designed to stay invested for a long-term horizon. At least, for 10 years of horizon.

Why? Because, the charges are frontloaded. Moreover, the loyalty additions are added after you stay invested for 10 and more years.

Tip 3 to buy low-cost ULIP: Purchase high-value life cover

So invest money in buying ULIP. That will help you accumulate capital over a period.

Now, the lever effect is that all the premiums you pay towards ULIP are tax exempted under Section 80C, of the Income Tax Act, 1961.

The higher you pay the premiums, the higher the tax benefits you will reap. You are tax exempted up to Rs.1.5 lakh. Moreover, the higher premium provides you a high-value life cover.

In ULIPs, you get a life cover of 10 times of the premiums invested. Say for instance, if you invest Rs.50, 000 annually, you get a life cover of Rs.5 lakh.

Bonus tip:

Don’t buy ULIP if you are over 50 years of age. Because the mortality charges are way too high for old age investors. Stay away from ULIP if you are over 50 years of age.

Looking for ULIP with Lower Charges? Buy ULIP Online as a Long-term Investment

Building a good financial portfolio needs a strategic planning and knowing which the good options for you are. Everyone’s risk appetite differs and the money one can invest.

However, if you are thinking to invest in ULIP, buy online and keep in mind that ULIP is a long-term investment product.

Here’s the list of Low-cost ULIPs

- Bajaj Allianz Future Gain

- Aviva i-Growth

- HDFC Life Click2Invest

- HDFC Life ProGrowth Plus

- Edelweiss Tokio Wealth Accumulation

After all, it’s all about finding out the sweet spot between low-cost investment and high-returns. The Life Cover that you get is an added bonus.

Still got queries about low cost ULIPs?

Drop us a line in the comments. We’ll be happy to provide you unbiased solutions.

Here's encapsulating the top tips to invest in ULIPs with an affordable cost

Recommended Read: Here's Why it is Not a Good Idea to Exit ULIP Plan After the End of Lock-in Period