Having a life insurance is crucial. But, having a right type of life insurance at a low cost is a win-win situation. Read on to know how you can save money before you buy a life insurance policy.

Life insurance policy is a must for everyone. It helps to provide financial security to your family and also to build a corpus to meet your future financial goals. It is obvious to look for ways to lower the life insurance premium. If buying life insurance is a must and you are about to buy life insurance, then the constant question that would be there in your mind is, how to buy life insurance at lower cost or how can you lower life insurance premium. But how to reduce the cost of your life insurance purchase premium? Read on to know more, because this post will reveal secrets of getting the life insurance premiums.

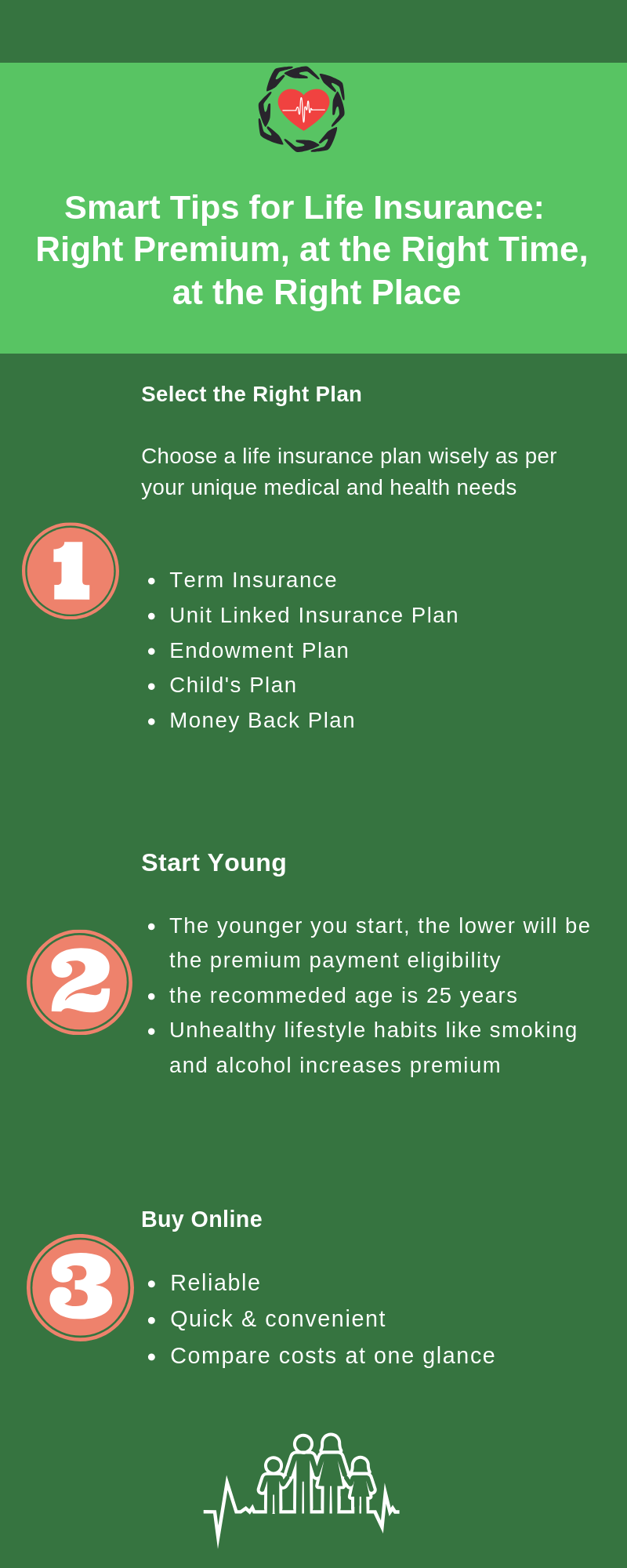

3 Simple Ways to Reduce the Cost of Your Life Insurance Purchase

1. Select the right type of life insurance

There are several type of life insurance policies. Assess your financial needs and accordingly decide the right type of life insurance you need to buy. Each life insurance policy is meant to meet your different requirements.

Types of Life Insurance

Term Plan - A term plan is pure insurance product that covers the life assured against an untimely death.

Unit linked insurance plan (ULIP) – ULIP is a combination of insurance and investment. Depending on your risk investment you can invest your money.

Endowment Plan - An endowment plan is a traditional type of insurance plan. It offers a life cover and also an opportunity to start saving.

Child’s Plan - Long term plan for child’s education or marriage. If you are already married and have a young baby, child plan is a good option to think about.

Money Back Plan - A money-back plan is meant to meet your short-term financial goals. It will offer you returns as a percentage of sum assured over a regular interval of time.

You can list out all your short-term and long-term financial goals. Those answers will help you to choose the right type of life insurance, consequently, by saving money because you won’t waste money on buying unwanted life insurance.

Bonus Tip: With the help of the life insurance riders you can widen up the base policy coverage. However, it is highly suggested to buy only those riders that are necessary.

Apart from the fact that you should be buying a right type of life insurance, it is equally important to select the right way of paying premiums, whether single pay, limited pay, or regular pay. Moreover, it is also crucial to decide the way of receiving the payouts.

2. Buy Life Insurance when you are younger

The younger you buy, the better, the cheaper is the premium. For instance, if you buy a term plan at the age of 30 years, it will cost you approximately in the range of Rs.8,000- Rs.10,000 p.a. whereas the same policy if purchased at an older age, say, at the age of 50 years, will be approximately in the range of Rs.30,000- Rs.35,000. Whatever is your current age, don’t delay further. Just buy the right type of life insurance policy, before it is too late. Bonus Tip: Living a healthy lifestyle, will make you shell out a lower amount of life insurance premium. For instance, a non-smoker will have to pay a lower premium than someone who smokes or consumes alcohol.

3. Buy Life Insurance online

You can buy life insurance online. Buying online has its own benefits.

Benefits of buying life insurance online:

Pocket-friendly – Insurance companies spend a lot of time and money in managing and administration to sell insurance offline. When someone buy insurance online, insurance company saves a ton of money, which is then passed on to the customers in the form of various discounts,

Hassle-free – Completely hassle-free purchase of life insurance. There’s no need of much paper work. And you get insurance policy issued in a very short frame of time.

Compare Quotes – You can compare quotes from the top insurance providers easily and quickly online. When you visit Coverfox.com, you just have to enter few basic details about the person for whom you wish to buy life insurance policy. As soon as you enter the details, Coverfox.com fetches the premium quotes from different life insurance companies so that you can compare – the policy features, inclusions and exclusions, terms and conditions, and premium quotes.

By comparing quotes from the top insurers, you can simply select the right types of life insurance policy in no time and at a lower cost.

Three Best Tips to Lower Your Life Insurance Premium

- Buy the right type of life insurance with only necessary add-on covers

- Buy at a younger age to get the best quotes and maintain a healthy lifestyle

- Compare and buy life insurance online to get the best premium quotes

Listed below are some great tips to save on your life insurance purchase

Bonus Tip: Talk to the Experts’ Team at Coverfox.com to guide in buying the right type of life insurance policy at lower premiums. If you have any queries, do let us know in the comments section below. Would be more than happy to answer them.

.jpg)