Skipping out on life insurance because of something you've heard? It's time for a fact-check. In this article, we look at some of the most common life insurance myths and reasons to disregard them.

Very often people take the big decisions in life following advices or opinions shared by friends or family members. But how can you know for certain what you’ve heard is, in fact, true? When it comes to false pieces of information floating around, the life insurance segment has seen its fair share. In this article, we attempt to break some of the most commonly believed myths surrounding life insurance and shed some light on how life insurance actually works.

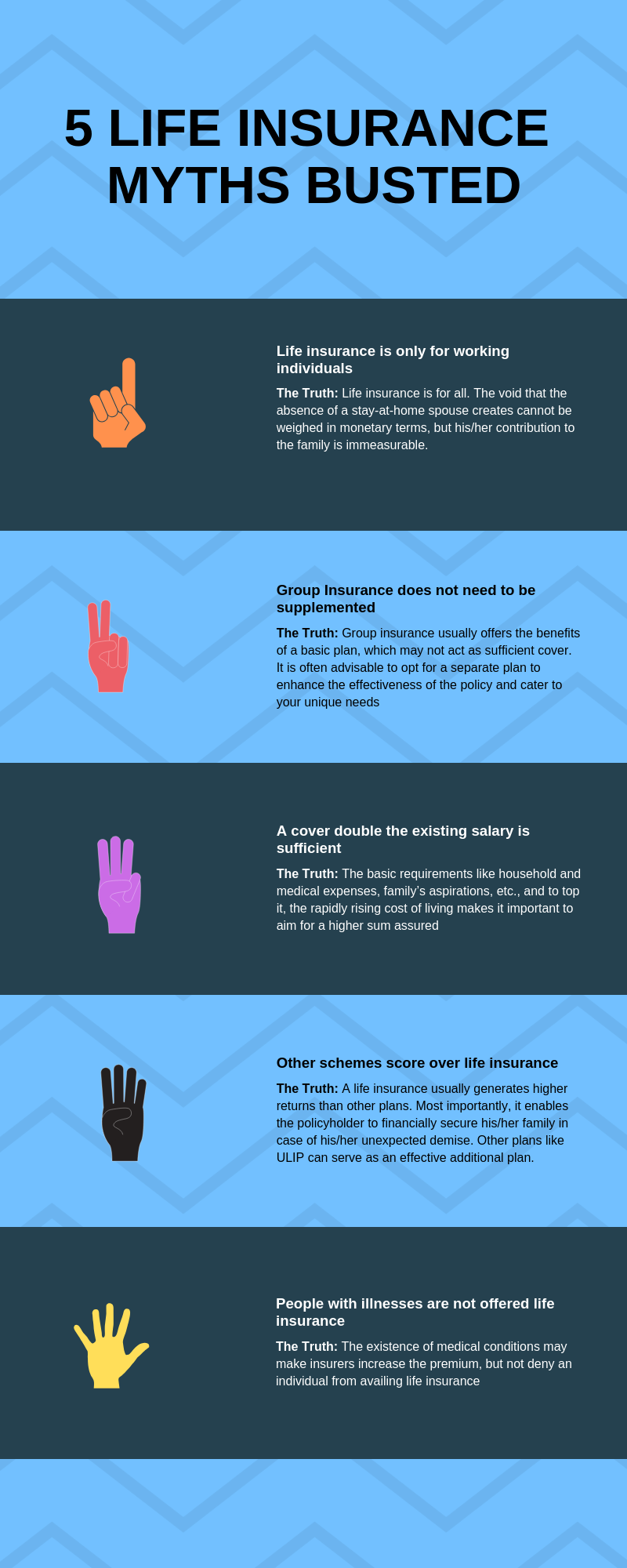

5 Popular Misconceptions About Life Insurance

Myth 1 - A stay-at-home spouse does not require life insurance.

Fact: Life insurance is as important for the stay-at-home spouse as it is for the employed spouse. It has been observed that life insurance policies are usually only availed by and for people who are employed. The fact is life insurance is equally important for the stay-at-home parent. While the individual may not be generating income, consider the expenses that would be placed upon the family should the person be no more.

Picture this - if a stay-at-home partner passes away, what are the changes that will take place in the house? The working partner is going to have to invest more time and efforts at home, which, in turn could mean that the individual would have to take some time off work. Then, there is the cost incurred on hiring a nanny or domestic worker to help with the household tasks. So, it’s not only the emotional turmoil one has to undergo; there are financial implications to be borne as well. To protect the family from feeling the financial pinch, it is recommended that all the family members get a life insurance cover.

Myth 2 - My company has included me in their group life insurance. I don’t need another plan.

Fact: Well, the truth is an individual is only covered under the group life insurance policy until the time he or she is employed with the firm. Once the person has left that particular job, then he or she is no longer going to be covered. Hence, there definitely is a need to have separate insurance plan.

Also, a group insurance scheme may not be the best fit to match one's needs given that the life cover is most likely going to be very basic. Thus, it only makes sense to take a separate life insurance cover, apart from the group insurance scheme taken by the company. One must have enough life insurance cover to take care of all debts and support those who are dependent on him or her. If a group life insurance policy fails to do this, then getting a separate life insurance cover is crucial.

Myth 3 - A life insurance coverage that is twice my salary will do.

Fact: Taking into account the financial requirements of the dependents and the rising cost of living, a sum assured that is only twice the current salary would be too little. To save some money, people sometimes compromise on the coverage they avail by choosing a sum assured that is two or three times their income. While the amount of life insurance cover would depend on each person's specific situation, a coverage of this range would not suffice.

There are a number of factors that need to be considered while deciding the coverage amount - medical bills, family’s life goals, pending debts, family’s household expense, etc. Undertake a cash flow analysis to ascertain the amount of insurance that must be taken and only then purchase a suitable policy. It is generally advised to go for a coverage amount that is 15 to 20 times of one’s annual income.

Myth 4 - I’m better off investing money in other schemes rather than buying life insurance.

Fact: Unless the other investments fetch considerable returns that is guaranteed to take care of the dependents, having a life insurance in place is a must. The intention behind getting a life insurance plan is so that one’s family continues to remain financially secure in the event of the life assured’s demise. If the individual, however, wants to benefit from wealth creation, while also staying financially secure, he or she can consider going for a Unit Linked Insurance Plan ULIP.

ULIPs are insurance cum investment plans that offer risk coverage, and at the same, invest part of the money in stocks, bonds or mutual funds. Comparing life insurance with other investment options like mutual funds wouldn’t be right since both of them function quite differently. However, if one wants to benefit from both wealth creation and financial protection, a ULIP is recommended.

Myth 5 - With my medical condition, nobody is going to let me avail life insurance.

Fact: Insurance companies generally do not refuse life insurance cover to those who are suffering from any medical ailment. However, should a condition be detected, they can raise the premium rates, considering that the risk is higher.

Making a full disclosure is necessary with regards to an individual’s medical history while applying for a life insurance plan. The reason behind this is that the insurance company needs to know how much risk they’re taking by extending coverage to a particular person. At the time of sending an application for a life insurance cover, one must make sure never to suppress important facts like the medical history. Should the company find out about it later, it can refuse to pay out the claim on grounds of non-disclosure of material facts.

Going without a life insurance cover is a big risk to take mainly because it is one's loved ones who will bear the brunt. Don't be misled by false pieces of information going around. Instead, spend some time researching to find out what is true and untrue. Keep the above-listed points in mind while buying an insurance plan. This way, securing the financial future of the loved ones will be an easy task.

Read on to bust 5 popular myths on life insurance.

.jpg)