There are mistakes that people have been committing when it comes to purchasing term insurance at an incorrect age. Learn about the right age to buy a term plan and get busted right away!

You might fit into your dear friend’s outfit.

But, the idea of one size fits all, definitely cannot be applied for Term insurance plans.

Say for instance, you are 30 years old and want to opt for a good term life plan. At the same time, you come across certain companies in the market that are allowing you to buy a term plan at the age of 75 years too!

It may sound promising and tempting. But it is certainly not recommended to buy a term plan that covers you till 60 years of age under any conditions.

So the question is….

…20s, 30s, 40s or When?

Because,

“Life is unpredictable and keeps throwing unexpected events and surprises at us, without any warning.”

While an unpleasant event like death may keep your family member’s devastated financially and emotionally, a good term plan can help them secure financially, if not emotionally.

Though, “It’s never too late or never too early to buy a term plan!”

A million dollar question yet pops-up in your mind, “When is the best age to buy a term plan? “

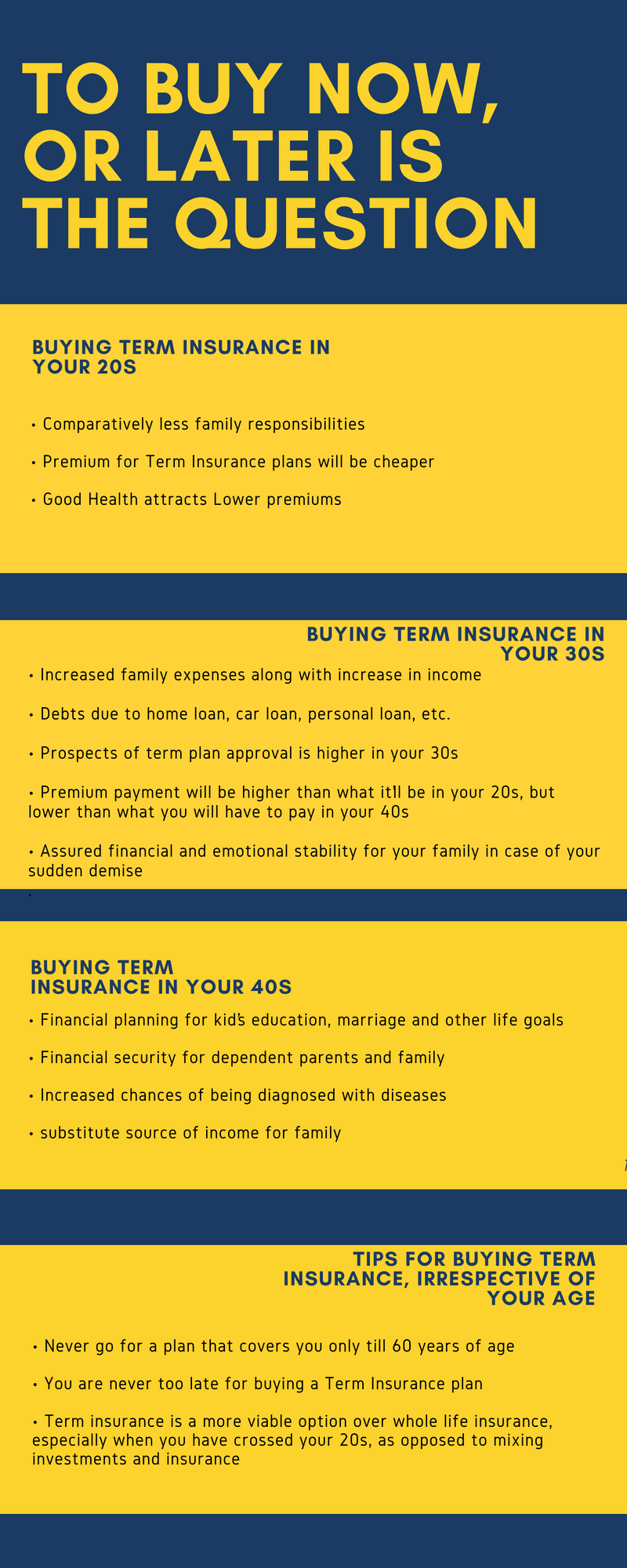

Let’s have a look at a few scenarios that will best describe your needs for buying a term plan considering different age groups:

In your 20s?

In your 20s, you would have just finished your education and started your professional career. You may be still dependent upon your parents, and have lesser responsibilities. Purchasing a term plan at this age would be relatively cheaper.

To add to it, the risks are also lower. This is the age when a term plan would be useful to clear off your debts like education loan and support your family financially in your absence. Remember, this would work only in your absence.

Besides, the premium paid towards these policies and the income accrued are both eligible for tax deductions.

For example, if you are a 24-year-old non-smoking working woman, drawing an annual income of Rs.3-5 lakhs per annum, your annual premium for term plan would be barely around Rs.3,880.

Besides you would also get additional benefits of terminal illness and life stage benefit and you wouldn’t have to pay separately for them with certain insurers.

In your 30s?

Generally when you hit your 30s, you get married and have a family. Your income might rise due to your work experience, but, your financial liabilities also increase at the same time. You learn to handle your funds responsibly.

Apart from concentrating on your kid’s education, you also have financial liabilities like car loan, housing loan, personal loans etc. Considering your family’s needs and your debts, now would be a good time to opt for a term plan with a monthly income option.

Besides, the premiums for a term plan would also be relatively lower, if you don’t wait to hit your 40s!

It has also been noted that generally the claim rejection ratios are relatively lower if the term insurance policy has been active for more than 10 years.

But again, ensure that you disclose all the possible details regarding your health, your habits and your financial liabilities to avoid any claim rejections!

It’s better at this stage not to mix investments and insurance. So, it is advisable you opt for a term insurance over whole life insurance products. This is the time you ensure an emotional and financial protection to your loves ones.

Insurers also find it safe to offer a term insurance plan in your 30s because at this stage you are stable income wise.

In your absence your family would have a financial security of re-paying your debts with the lump-sum amount as well as have an option to take care of their daily expenses.

For example, if you are a 32-year-old non-smoker working man, you can easily get a cover of Rs. 1 crore for an annual premium as low as Rs. 7,000.

In your 40s?

In your late 40s, you might have had cleared certain long-term loans. But, responsibilities like your kid’s higher education and the planning for your peaceful retirement still hits your head.

You also start looking out for additional sources of income to take care of these responsibilities. Your health also doesn’t support because of the increasing age.

You start falling prey to critical illnesses or lifestyle-related diseases.

So, before you start thinking that late 40s would let things drift away, this is the right time to buy a term plan to cover your financial responsibilities and liabilities etc [if you haven’t already].

Now, thinking for just a Rs. 1 crore cover might not be sufficient. You need to think big and call for a higher cover.

For example, if you are a 48-year-old non-smoker, drawing an annual income of Rs. 10 lakh and above per annum, you might have to shell out a sum of Rs. 37, 000 as annual premium for a cover of Rs. 2 crore.

Myth or Fact?

They say that it is best to opt for a term plan for people nearing their retirement.

But, is it true?

Here’s the answer: Firstly, the premium for a term plan would be quite high for people nearing their 50s or in their late 50s as compared to someone who is in their 20s. This totally changes the idea of approaching for a term plan.

The risks associated are also higher as compared to someone who is younger. Along with the risk, the underwriting risk too increases with increasing age.

Therefore, it is best to buy a term plan at an early age to cover your child’s education, financial loans and other milestones, safeguarding your spouse’s retirement etc.

However there are certain situations in life when you might feel the necessity to opt for a term plan in spite of your increasing age or in your 50s and your willingness to pay a higher premium. The scenarios are mentioned below:

- If you are the only bread earner of the family

- If you have financially dependent kids

- If you have a spouse dependent on your pension

- If you have loads of financial liabilities and debts

- If you have to work after your retirement

You can certainly buy a term plan irrelevant of your higher age to surpass the above mentioned scenarios.

In case you are no longer there, let your family lead a financially secured life while you go to sleep forever.

Here's a quick look to determine when you should buy a Term Insurance plan.

'If you still are not sure whether you're at the right stage to buy a term life plan, or if you already have one and want more information, our Term Life insurance experts are just a call away.

Just ask them to review your options at 1800-209-9920 toll free or simply leave a comment below. :)’

Also Read: Guide To Buying Best Term Insurance

.jpg)