Pure risk in life insurance is classified as, an 'only death benefit plan' in which, only the loss of the life is covered. Term insurance plan is one such pure risk protection cover.

What is Pure Risk Life Insurance Cover?

Before we dive into the advantages of term insurance, let's first understand what pure risk life insurance cover means. Pure risk is a type of risk that has only two possible outcomes: loss or no loss. In the case of life insurance, the pure risk is the risk of death. A pure-risk life insurance policy provides a death benefit to the beneficiaries in the event of the insured's death during the policy term. This type of insurance does not have any investment component, and the premiums paid go towards the death benefit only.

Advantages of Pure Risk Life Insurance Cover

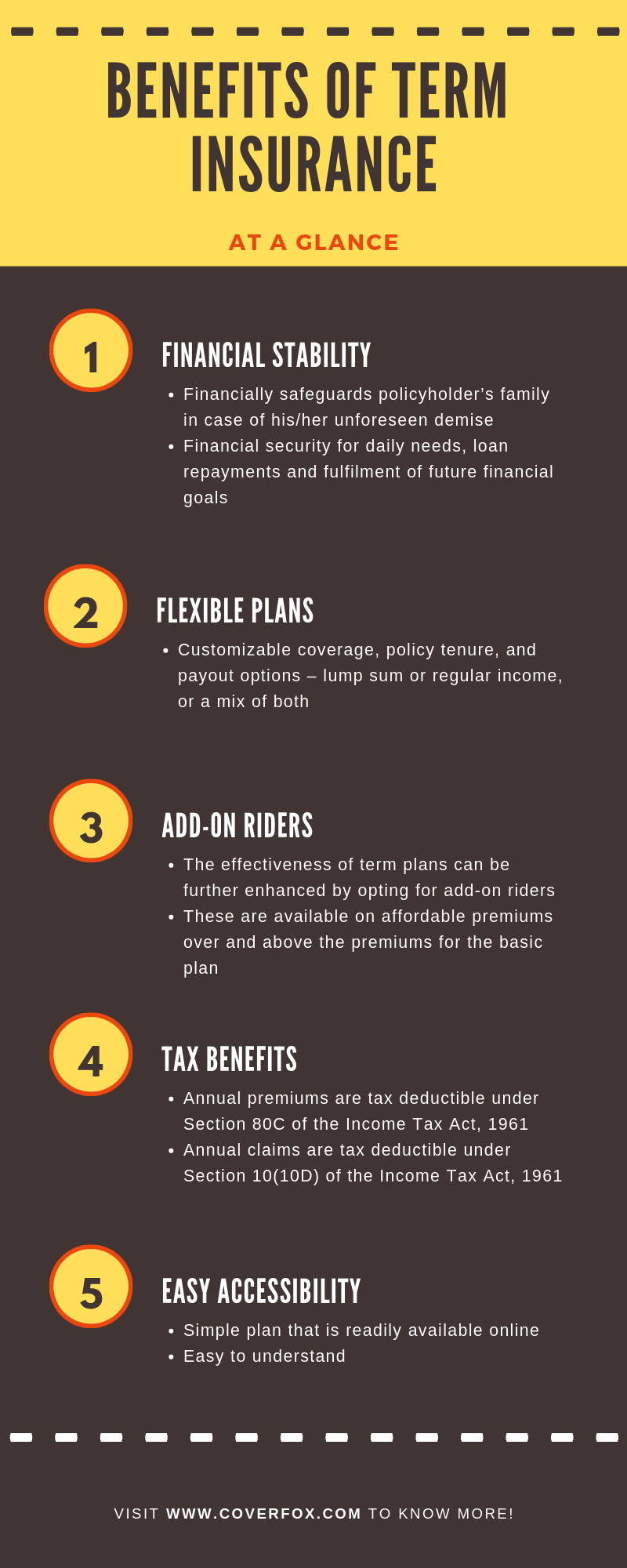

Here is the list of advantages of Pure Risk Life Insurance Cover:

Provides High Coverage at Low Premiums

One of the biggest advantages of term insurance as a pure risk protection plan is that it provides high coverage at low premiums. Since there is no investment component, the premiums are significantly lower compared to other types of life insurance. This makes term insurance an affordable option for individuals and families who want to ensure financial security for their loved ones in case of their untimely demise.

Flexibility to Choose Policy Term and Coverage Amount

Term insurance offers flexibility in terms of policy term and coverage amount. Policyholders can choose the policy term based on their needs and financial goals. They can also choose the coverage amount based on their income, liabilities, and future financial obligations. This flexibility allows individuals to customize their term insurance policy to suit their specific needs and budget.

Provides Financial Security to Dependents

The primary purpose of life insurance is to provide financial security to the insured's dependents in case of their death. Term insurance, as a pure risk protection cover, fulfills this purpose effectively. In the event of the insured's death during the policy term, the beneficiaries receive the death benefit, which can help them cover their living expenses, pay off debts, and maintain their standard of living. This financial security can be crucial for families who rely on the insured's income to meet their financial needs.

No Maturity Benefit

As mentioned earlier, term insurance does not have any investment component, which means there is no maturity benefit. This may seem like a disadvantage, but it is actually an advantage for individuals who want to focus on pure risk protection without any distractions. The absence of a maturity benefit also means that the premiums are lower, making term insurance an affordable option for individuals who want to ensure financial security for their loved ones.

Tax Benefits

Another advantage of term insurance as a pure risk protection plan is the tax benefits it offers. The premiums paid towards a term insurance policy are eligible for tax deductions under Section 80C of the Income Tax Act, up to a maximum of Rs. 1.5 lakhs. Additionally, the death benefit received by the beneficiaries is also tax-free under Section 10(10D) of the Income Tax Act. These tax benefits make term insurance an attractive option for individuals who want to save on taxes while securing their family's financial future.

Riders for Enhanced Coverage

Term insurance policies also offer riders that can be added to the base policy for enhanced coverage. These riders provide additional benefits such as critical illness cover, accidental death benefit, waiver of premium, and more. By adding these riders, individuals can customize their term insurance policy to suit their specific needs and provide comprehensive coverage for themselves and their loved ones.

Easy to Understand and Purchase

Unlike other types of life insurance, term insurance is easy to understand and purchase. The concept of pure risk protection is simple, and there are no complicated investment components involved. This makes it easier for individuals to understand the policy and make an informed decision. Additionally, term insurance can be purchased online, making it convenient and hassle-free. With just a few clicks, individuals can compare policies, choose the one that best suits their needs, and purchase it online.

Conclusion

Term insurance, as a pure risk protection cover, offers several advantages that make it a smart choice for individuals and families. It provides high coverage at low premiums, offers flexibility in terms of policy term and coverage amount, and provides financial security to dependents in case of the insured's death. Additionally, term insurance offers tax benefits, riders for enhanced coverage, and is easy to understand and purchase. With all these advantages, it is no wonder that term insurance is one of the most popular and preferred options for life insurance. So, if you want to ensure financial security for your loved ones, consider term insurance as a pure risk protection cover.

.jpg)