Are you the only breadwinner of your family? Does a question like “What will happen to my family when i am gone” bother you? Read this interesting article to know the importance of term insurance in today’s life.

“The dangers of life are infinite, and among them is safety”- Goethe.

Umm.. Trying to understand the dense perplexity of life is difficult! As humans we take all the necessary precautions whenever and wherever we can. However there are times where circumstances are uncontrollable and not in our hands. Since life is always at risk, I am sure we would not want our family and loved ones to suffer followed by the repercussions once we leave this world. Term insurance in that case is a Good Samaritan!

Let's not get into the complexity of life and better gather some information on Term insurance.

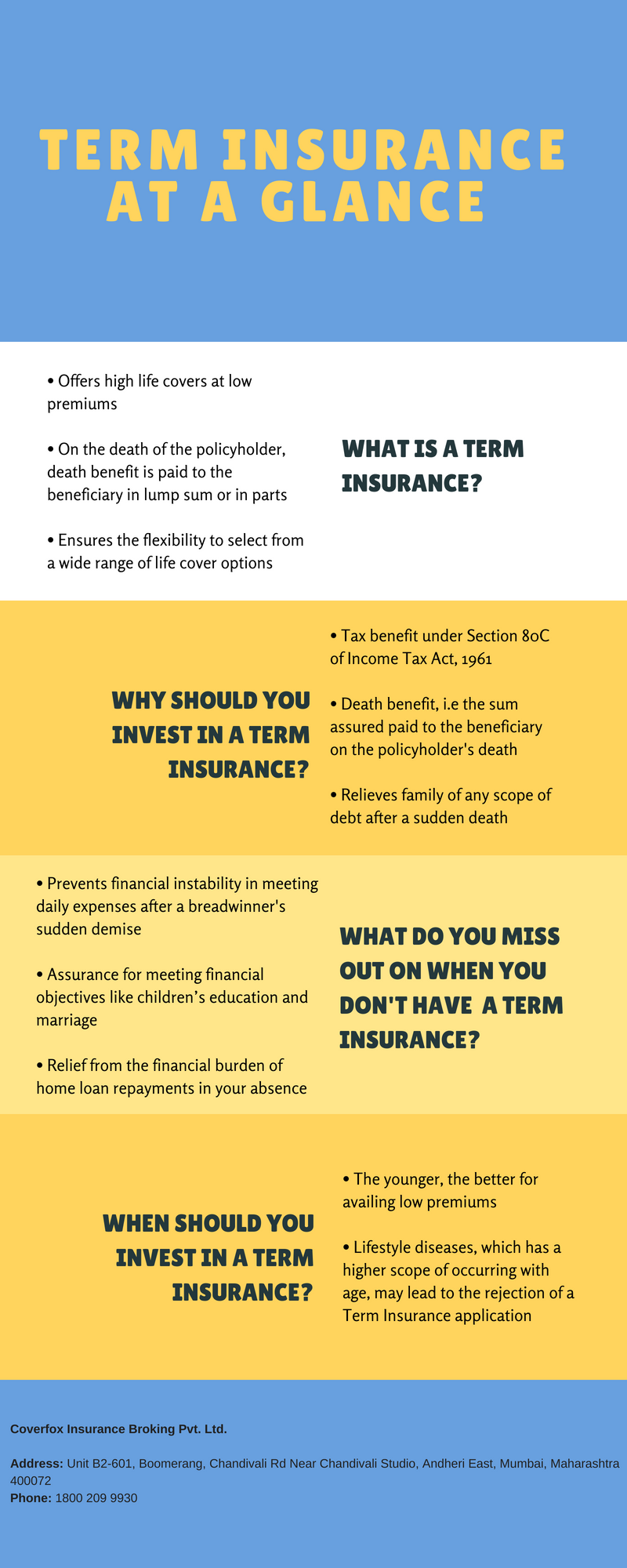

What is Term Insurance?

Term life insurance is an insurance that provides coverage or covers your life's risks. These are high life covers with low premiums. In short, when a person dies, the death benefit will be paid to the beneficiary in lump sum or in parts.

Since term insurance has gained a lot of popularity in the past few years, most of the top end insurance companies are offering higher coverage at low premiums. A wide range is available in the market and one can choose as per ones capability and requirement.

Term Insurance at a Glance

What are the benefits of a term insurance policy?

Tax saving

Believe it or not! A term insurance is not only helpful when you are gone, but also helps when you are alive. You can get a tax benefit of Rs 1.5 lakh maximum under Section 80C of the Income Tax Act, 1961.

Tax Free payout for beneficiary (death benefit)

You heard it right! Your loss cannot be fulfilled, however there is one thing that will keep your loved ones at ease. Yes, term insurance will pay them the entire sum assured once you are gone without any deductions, which will let them live with a sigh of relief.

Burden of debt

World's greatest pleasure is of course seeing your family happy, however wouldn’t you feel stress free when a family is relieved peacefully without any financial issues and debts? There will be no debt collectors and other day to day expenses like electricity bills, house maintenance, and water supply will all be taken care even when you aren’t around.

Loved ones are taken care even when you are gone

Life becomes difficult if a breadwinner of the family is gone. It seems difficult if the family will be able to live the same lifestyle or will be able to cope-up with the financial debts etc. with sudden loss of income. However, with term insurance in hand things sail smooth even in your absence.

Repercussions of not having a Term insurance policy

Daily expenses

With the sudden demise of the bread-winner, it becomes difficult for the family members to sustain their daily living. Imagine life without our basic necessities? (Food, shelter and clothing).Term insurance comes to your rescue in the need of the hour.

Loss of breadwinner of the family

If the family is completely dependent on you, guess how difficult it would be to cope-up with the day to day living. In case if you have siblings or if you are taking care of someone’s education, old age of parents etc. facing the financial crunches would be a big task..

Debt of home loan

You bought your dream house from your hard earned money and your sudden demise has made it difficult for your family to arrange the EMI's of the home loan. Not having a term policy especially when you are financially loaded will make it difficult for your family to pay off the debts in your absences.

No peace of mind and emotional vulnerability of family members

The family not only has to go through the emotional loss of their loved ones but also has to become a victim to the day to day financial crisis, unwillingly. A situation like this can land your loved ones in trouble.

When should you buy term insurance policy?

It is said that “Life decisions should not be taken too early or too late”. However same is not the case when it comes to Term insurance policy.. It is advisable to buy term insurance policy when you are young. They say, the early you start, the lower you pay the premiums.

As lifestyle and standard of living increases, habits such as drinking alcohol, smoking, and eating unhealthy food increases too taking a toll on your health. Please keep the below two important things in mind while buying a term insurance policy.

The younger you buy, the lower will be your premiums

For example: A 25 year old non-smoker will have to shell out a premium as low as Rs.525 per month for a sum assured of Rs.65 lakh. However, the same would not be the case with a 40 year old non- smoker. He might have to shell Rs.1500 per month for a cover of Rs.65 lakh.

Medical Examination

You have to undergo a medical check-up while applying for a term insurance policy. In case you have crossed your thirties, there are higher chances of you getting attracted towards a lifestyle related disease. This in turn could reject your proposal with the insurance company.

Hence it is vital to buy a term insurance plan for all the working audiences and especially when you are the sole earning person of your family. The more early you buy, the more you will be benefited out of it. You certainly can't afford to not have a term insurance plan, for your family to lead a peaceful life once you are gone!

Recommended Read: Advantage of Term Insurance as a Pure Risk Protection Cover

.jpg)