Term Life Insurance - The ultimate pocket-friendly solution which offers complete peace of mind by taking care of your financial responsibilities in your absence.

The happiness of holding your first paycheck can never be described in just a few words. The joy, happiness and excitement are beyond compare. This paycheck also starts the transitions of your life. From a carefree single adult you have now become a grown up with responsibilities. There are many such important life-changing transitions in an individual’s life like Marriage, Starting a Family, First Home Loan, Children’s Education and so on.

There is one companion that you must have with you in your life’s journey starting from the day of your first paycheck until retirement, and that Super Hero is Term Life Insurance Plan. This companion will always fulfil its duty of taking care of your loved ones, your liabilities and your debts in your absence. Term Life Insurance is an ideal pure risk transfer tool.

So, you must be wondering as to why any financial advisor or agent that you have come across hasn’t recommended it to you yet? Read on to know more about the biggest secret, “Why Insurance Agents Hide Term Life Insurance from You?”

What is a Term Life Insurance?

Term life insurance is a pure risk transfer tool. It is an insurance product where you pay premiums at regular intervals and the insurer agrees to pay your nominee the agreed life cover amount in the event of your untimely death during the policy term. If you survive the policy term, nothing is paid back as survival or maturity benefit. This is because term life insurance plans do not have any saving or investment component in them.

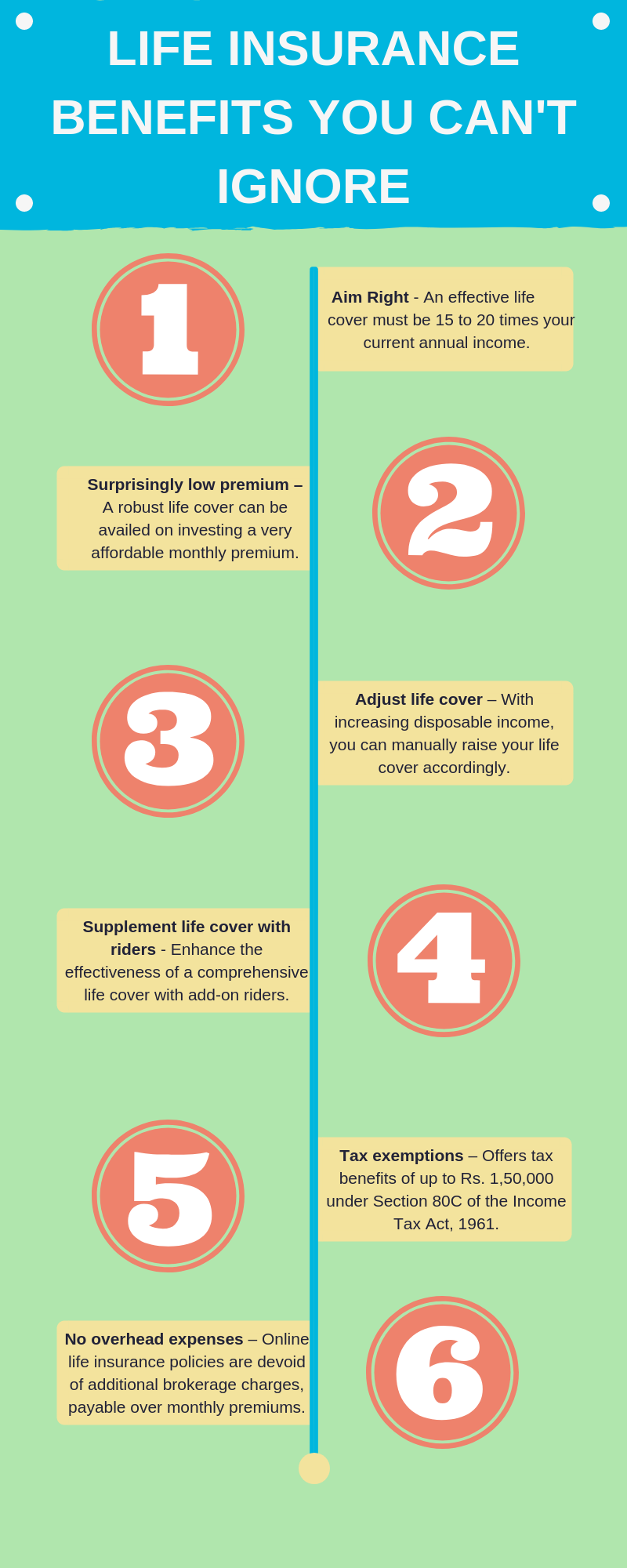

This Super Hero has super six benefits that are a secret to you:

Benefit 1 - Higher Protection: You plan to spend every waking moment of your life for the benefit of your near and dear ones, you earn for them and try to provide every possible item of material comfort within your reach. But this comfortable life can take an ugly turn and turn into a dreadful struggle for your loved ones if you are not around anymore. A term life insurance plan takes over the financial responsibility of taking care of your family, paying off your debts and financial liabilities. This is easily done as term life insurance plans offer you a high amount of life cover.

The minimum amount of life cover offered under a term life insurance starts at Rs 25 lakhs with some companies offering even a lower cover than this. On the other hand, the sky is the limit for the maximum amount depending upon your annual income and the insurance company’s underwriting guidelines. The ideal amount that you should choose as a life cover must be 15 to 20 times your current annual income. This will be enough to take care of your loved ones in your absence for the next 10 to 15 years keeping the inflation in mind as well.

The easy availability of a high life cover under a single term life insurance plan limits the chances of a financial advisor or agent adding more policies to your financial bucket. A secret which makes them hide this superhero knowingly or unknowingly from you.

Benefit 2 – Lower Premium: A term life insurance plan provides you with a huge life cover and believe me when I say, it is very pocket-friendly and cheap too. In fact, when you compare it with your other daily expenses you might find that it is even cheaper than what you spend on your evening tea and snack. Check it out for yourself here, if a 30-year-old male, non-smoker gets a term life insurance plan of Rs. 1 Crore for a term of 50 years i.e. till the age of 80 years, he would be paying a premium of just Rs. 730 per month only. This effectively comes to Rs. 25 per day. How’s that!

Term life insurance plans do not have any savings or investment component build in them. They offer pure protection only and nothing is paid back to the life insured on surviving the policy term.

Financial advisors and agents often present this feature to demotivate individuals from buying a term life insurance plan. Know why? Because premiums determine the commission payable to them. Higher the premium, higher is the commission and vice versa. However, this important feature enables you to get highest possible life cover at very pocket-friendly rates, this is another secret of this superhero which you now know.

Benefit 3 – High Flexibility: Did you know a single term life insurance plan can grow and change as per your rising life stage needs? They are highly flexible and allow you to increase your life cover on a yearly basis by a fixed percentage of 5 or 10 till it becomes double of your existing life cover amount.

You can also manually increase your life cover on important milestones of your life, like 50% on your marriage, then by another 25% on the birth of your first child and then again by another 25% on the birth of your second child. Term life insurance plans also allow you to extend your life cover to your spouse under the same plan and that to up to 50% of your life cover amount.

This flexibility closes the doors on the chances for the financial advisors and agents to add another plan to your financial bucket. So, here’s another secret revealed for hiding this super player from you.

Benefit 4 – Customizable Comprehensive Protection: Term life insurance plans are completely customizable to offer you a higher level of complete and total protection by attaching add-ons known as Riders. These riders allow you to meet various protection needs like cover against critical illness, surgery, hospital care, accidental death and disability, and so on. These add-ons come as an inbuilt feature in the new age term life insurance plans or can be attached to your existing plan as and when your needs change.

Addition of a rider in a term life insurance plan takes away the need for buying a separate product to meet that protection need. No more need means, no more chance of buying another product from the financial advisor or agent. Yet another reason for hiding a term life insurance plan from you.

Benefit 5 – Tax Savings: A term life insurance plan provides the much needed financial protection to your loved ones in the absence of the breadwinner but wait its benefit does not end there. The premiums that you pay towards your term life insurance plan makes them eligible for tax deductions and provide you with the much needed relief from the tax axe.

You as an individual can avail a maximum deduction of Rs. 1,50,000 under Section 80C of the Income Tax Act, 1961 on the premiums paid for a term life insurance plan. Plus, an additional deduction of Rs. 25,000 on the qualifying riders providing health benefits. Also, the death benefit amount that will be paid to your loved ones on your tragic demise under a term life insurance plan is also completely tax-free in their hands under Section 10 (10D) of Income Tax Act, 1961. To add a cherry on the top, there is no cap on the amount that can be paid by the life insurance company under this head.

This benefit again takes away another opportunity from the hands of the financial advisors and agents to give you an additional tax saving product during the JFM quarter every year. Yet another secret revealed just for you.

Benefit 6 – Zero Commission: This is the biggest revelation till now. We all know that financial advisors and agents receive a commission on the products they sell to people. However, with the dawn of new age online term life insurance plans they have just lost an income source from their selling list.

The new age online term life insurance plans pay zero commission as the entire transaction takes place on the insurer’s website. There is a direct transaction between you and the insurance company and no intermediary is involved in sourcing the business for the life insurance company. The insurance companies also in turn pass on this benefit to you by lowering your premiums rates.

As no commission is received, financial advisors and agents are much reluctant to offer this superhero to you.

The Verdict

Now, if you still do not want to make term life insurance, the ultimate superhero, a companion in your life’s journey, you must be one of those people who have nobody in their life who would get financially affected in your absence. Or maybe, you might be liking your financial advisor or agent very much to pass on the benefits of a term life insurance plan in your life.

If that's not the case, then get yourself protected with a term life insurance plan right here and right now at Coverfox.com.

Here are the top benefits of life insurance you can't ignore

Recommended Read: Is Your Insurance Agent Hiding Something From You?

.jpg)